Read the entire articleJapan is likely to join the Asian Infrastructure Investment Bank within a few months, according to the country’s ambassador to Beijing, a move that would see Tokyo break ranks with Washington and leave the US as the only big holdout.

Masato Kitera told the Financial Times he agreed with Japanese business leaders’ belief that the country would sign up to the China-led development bank by June.

“The business community woke up late, but now they have mounted a big campaign for the AIIB which appears to be very effective,” Mr Kitera said…

A Japanese move to join the bank would be a reversal of rhetoric and, for China, the biggest coup yet given the fractious relationship between the two Asian powers.

Japan also has strong links to the rival Asian Development Bank, the head of which it traditionally appoints, and has in the past questioned the need for a new bank...

No country was seen to be as supportive of the US position as Japan — in part because many officials in both countries saw the AIIB as a direct challenge to the Japanese-controlled Asian Development Bank.

But Japanese executives look on China’s ambitious plans to help build infrastructure in the region as a huge business opportunity, as well as a chance to help repair frayed relations.

March 31, 2015

Japan "Wakes Up," Joins China-led Development Bank (And Then Backs Out)

It’s official: the US is on its own when it comes to opposing the China-led Asian Infrastructure Investment Bank (see here for full summary of AIIB developments). We suppose it was only a matter of time, but news that Japan will seek membership in a matter of months will likely still come as somewhat of a surprise to Washington, given the otherwise tenuous relationship between the two countries and considering Japan’s leadership role in the ADB. Nevertheless, the Japanese have apparently come to the same conclusion as Australia and South Korea: not joining simply isn’t an option no matter how loudly the US protests. Here’s more from FT:

March 30, 2015

Central Banks Warn: Investors May Get Crushed When They All Run for the Exits

Companies are selling bonds like madmen. This year through Tuesday, investment-grade and junk-rated companies have sold $438 billion in new bonds, up 14% from the prior record for this time of the year, set in 2013, according to Dealogic. This quarter is already in second place, nudging up against the all-time quarterly record of $455 billion of Q2 2014.

About $87 billion of these bonds funded takeovers, a record for this time of the year, the Wall Street Journal reported. The four biggest bond sales in that batch were for healthcare takeovers, including the Actavis deal whose $21 billion bond sale was the second largest in history, behind Verizon’s $49 billion bond sale in 2013.

Actavis had received orders for more than four times the bonds available, according to CFO Tessa Hilado. “You don’t really know what the demand is until people start placing their orders,” she said. “I would say we were pleasantly surprised.”

Brandon Swensen, co-head of U.S. fixed income at RBC Global Asset Management, couldn’t “see anything on the radar that’s going to slow things down materially,” he told the Wall Street Journal. His firm expects rates to “remain low.”

All of the investors chasing after these bonds expect rates to remain low. Or else they wouldn’t chase after these bonds. If rates rise, as the Fed is promising in its convoluted cacophonous manner, these bonds that asset managers are devouring at super-high prices and minuscule yields are going to be bad deals. And their bond funds are going to take a bath.

Read the entire article

About $87 billion of these bonds funded takeovers, a record for this time of the year, the Wall Street Journal reported. The four biggest bond sales in that batch were for healthcare takeovers, including the Actavis deal whose $21 billion bond sale was the second largest in history, behind Verizon’s $49 billion bond sale in 2013.

Actavis had received orders for more than four times the bonds available, according to CFO Tessa Hilado. “You don’t really know what the demand is until people start placing their orders,” she said. “I would say we were pleasantly surprised.”

Brandon Swensen, co-head of U.S. fixed income at RBC Global Asset Management, couldn’t “see anything on the radar that’s going to slow things down materially,” he told the Wall Street Journal. His firm expects rates to “remain low.”

All of the investors chasing after these bonds expect rates to remain low. Or else they wouldn’t chase after these bonds. If rates rise, as the Fed is promising in its convoluted cacophonous manner, these bonds that asset managers are devouring at super-high prices and minuscule yields are going to be bad deals. And their bond funds are going to take a bath.

Read the entire article

March 27, 2015

Matt Taibbi Takes Up SEC’s Andrew Bowden Regulatory Capture Scandal

Matt Taibbi has written a characteristically informative, incisive piece about the embarrassing spectacle of the SEC’s Director of Compliance Inspections and Examinations, Andrew Bowden, making sycophantic remarks about the private equity industry at a recent conference, a story we broke early last week. It’s bad enough to see a regulator so besotted by firms he oversees; it’s even worse in light of statements Bowden made less than a year ago the widespread fraud and misconduct he said his examiners were finding. As we wrote in our original post:

Bowden stated that the SEC had found “violations of law or material compliance failures” in more than half the firms examined. Let’s not put too fine a point on this: the SEC said that most firms were stealing from investors, either by accident or design. Bowden confirmed that view, later telling the New York Times’ Gretchen Morgenson that “investors’ pockets are being picked.”In case you have yet to see it, contrast that view of the industry with Bowden’s take a mere ten months later:

March 26, 2015

How Wall Street Used Swaps to Get Rich at the Expense of Cities

A recent report by Saqib Bhatti of the Roosevelt Institute describes a number of financial deals between Wall Street and municipalities as predatory. Bhatti asserts that these dirty transactions have forced cities and states to cut essential services to pay off the financial sector. On Tuesday, Bhatti’s ReFund America project issued a new report specifically directed at the financial problems of Chicago and calling on the city to fight back in the courts and elsewhere against these deals.

One of the main problems arises from the use of interest rate swaps to create synthetic fixed rate municipal bonds. You’ll get great rates, cities were told, and these interest rate swaps will protect you against interest rate hikes. Risks were downplayed, if they were mentioned at all. The chief of these is the risk of downgrades in credit rating. In those cases, the swap could be cancelled, inflicting massive termination penalties on the city. Other risks include the inability to refinance into a lower interest rate, because the swap runs for a very long term, and payments would eat up any gains. Bhatti says the City of Oakland refinanced one of its bonds, and continues to pay for the swap; he says it’s “like paying for insurance on a car that was sold years ago”.

Another trap was the pension obligation bond. The idea is to borrow the money needed to make up a shortfall in pension payments, with the idea that the pension plan would invest the funds at a higher rate of return than the bond after expenses.

A third trap was Auction Rate Securities. These are short-term securities that have to roll over every month or two. If an investor in ARS wants out, but the city can’t roll the ARS over, the city is stuck with huge interest rate bills. This happened to the Port Authority of New York and New Jersey, which saw interest rates jump from 4.3% to 20% in one week.

Read the entire article

One of the main problems arises from the use of interest rate swaps to create synthetic fixed rate municipal bonds. You’ll get great rates, cities were told, and these interest rate swaps will protect you against interest rate hikes. Risks were downplayed, if they were mentioned at all. The chief of these is the risk of downgrades in credit rating. In those cases, the swap could be cancelled, inflicting massive termination penalties on the city. Other risks include the inability to refinance into a lower interest rate, because the swap runs for a very long term, and payments would eat up any gains. Bhatti says the City of Oakland refinanced one of its bonds, and continues to pay for the swap; he says it’s “like paying for insurance on a car that was sold years ago”.

Another trap was the pension obligation bond. The idea is to borrow the money needed to make up a shortfall in pension payments, with the idea that the pension plan would invest the funds at a higher rate of return than the bond after expenses.

A third trap was Auction Rate Securities. These are short-term securities that have to roll over every month or two. If an investor in ARS wants out, but the city can’t roll the ARS over, the city is stuck with huge interest rate bills. This happened to the Port Authority of New York and New Jersey, which saw interest rates jump from 4.3% to 20% in one week.

Read the entire article

March 25, 2015

ABCs of the Coming Credit Crunch?

Dominant Social Theme: Markets go up and down. Not to worry.

Free-Market Analysis: This is a good analysis of what could go wrong with world markets (especially Western and US ones) and why ... It touches on a number of memes: Sort through them to better understand what's taking place, or what could take place – and could not.

More:

Maybe it's too quiet. Last week, Ray Dalio, the founder of the $165bn (£110bn) hedge fund Bridgewater Associates, wrote a widely-circulated note warning his clients that the US Federal Reserve risked setting off a 1937-style crash when it starts raising interest rates again.

Dalio provides us with a grim forecast here, and also offers us a question. Can even a modest rate increase destabilize markets worldwide? Are they that fragile? And what about vaunted central bank interference in the marketplace, not to mention the "plunge protection team"?

With all the buying power at its disposal, does not the Fed along with other central banks have the wherewithal to conquer any sudden downturn at least in the short term?

Read the entire article

Free-Market Analysis: This is a good analysis of what could go wrong with world markets (especially Western and US ones) and why ... It touches on a number of memes: Sort through them to better understand what's taking place, or what could take place – and could not.

More:

Maybe it's too quiet. Last week, Ray Dalio, the founder of the $165bn (£110bn) hedge fund Bridgewater Associates, wrote a widely-circulated note warning his clients that the US Federal Reserve risked setting off a 1937-style crash when it starts raising interest rates again.

Dalio provides us with a grim forecast here, and also offers us a question. Can even a modest rate increase destabilize markets worldwide? Are they that fragile? And what about vaunted central bank interference in the marketplace, not to mention the "plunge protection team"?

With all the buying power at its disposal, does not the Fed along with other central banks have the wherewithal to conquer any sudden downturn at least in the short term?

Read the entire article

March 24, 2015

They Are Slowly Making Cash Illegal

The move to a cashless society won’t happen overnight. Instead, it is being implemented very slowly and systematically in a series of incremental steps. All over the planet, governments are starting to place restrictions on the use of cash for security reasons. As citizens, we are being told that this is being done to thwart criminals, terrorists, drug runners, money launderers and tax evaders. Other forms of payment are much easier for governments to track, and so they very much prefer them. But we are rapidly getting to the point where the use of cash is considered to be a “suspicious activity” all by itself. These days, if you pay a hotel bill with cash or if you pay for several hundred dollars worth of goods at a store with cash you are probably going to get looked at funny. You see, the truth is that we have already been trained to regard the use of large amounts of cash to be unusual. The next step will be to formally ban large cash transactions like France and other countries in Europe are already doing.

Starting in September, cash transactions of more than 1,000 euros will be banned in France. The following comes from a recent Zero Hedge article which detailed what these new restrictions will do…

Read the entire article

Starting in September, cash transactions of more than 1,000 euros will be banned in France. The following comes from a recent Zero Hedge article which detailed what these new restrictions will do…

Read the entire article

March 23, 2015

Washington Blinks: Will Seek Partnership With China-Led Development Bank

Don’t look now, but Washington just blinked. As we’ve documented exhaustively over the past week, pressure has been building steadily for the US to strike some manner of conciliatory tone towards China with regard to the Asian Infrastructure Investment Bank, a China-led institution aimed at rivaling the US/Japan-backed ADB. Britain’s decision to join China in its new endeavor has prompted a number of Western nations to throw their support behind the bank ahead of the March 31 deadline for membership application. Because the AIIB effectively represents the beginning of the end for US hegemony, the White House has demeaned the effort from its inception questioning the ability of non-G-7 nations to create an institution that can be trusted to operation in accordance with the proper “standards.” Now, with 35 nations set to join as founders, it appears Washington may be set to concede defeat. Here’s more, via WSJ:

Read the entire articleThe Obama administration, facing defiance by allies that have signed up to support a new Chinese-led infrastructure fund, is proposing the bank work in a partnership with Washington-backed development institutions such as the World Bank.

The collaborative approach is designed to steer the new bank toward economic aims of the world’s leading economies and away from becoming an instrument of Beijing’s foreign policy. The bank’s potential to promote new alliances and sidestep existing institutions has been one of the Obama administration’s chief concerns as key allies including the U.K., Germany and France lined up in recent days to become founding members of the new Asian Infrastructure Investment Bank.

The Obama administration wants to use existing development banks to co-finance projects with Beijing’s new organization. Indirect support would help the U.S. address another long-standing goal: ensuring the new institution’s standards are designed to prevent unhealthy debt buildups, human-rights abuses and environmental risks. U.S. support could also pave the way for American companies to bid on the new bank’s projects.

“The U.S. would welcome new multilateral institutions that strengthen the international financial architecture,” said Nathan Sheets, U.S. Treasury Under Secretary for International Affairs. “Co-financing projects with existing institutions like the World Bank or the Asian Development Bank will help ensure that high quality, time-tested standards are maintained.”

March 20, 2015

Investors Crushed as US Natural Gas Drillers Blow Up

The Fed speaks, the dollar crashes. The dollar was ripe. The entire world had been bullish on it. Down nearly 3% against the euro, before recovering some. The biggest drop since March 2009. Everything else jumped. Stocks, Treasuries, gold, even oil.

West Texas Intermediate had been experiencing its biggest weekly plunge since January, trading at just above $42 a barrel, a new low in the current oil bust. When the Fed released its magic words, WTI soared to $45.34 a barrel before re-sagging some. Even natural gas rose 1.8%. Energy related bonds had been drowning in red ink; they too rose when oil roared higher. It was one heck of a party.

But it was too late for some players mired in the oil and gas bust where the series of Chapter 11 bankruptcy filings continues. Next in line was Quicksilver Resources.

It had focused on producing natural gas. Natural gas was where the fracking boom got started. Fracking has a special characteristic. After a well is fracked, it produces a terrific surge of hydrocarbons during first few months, and particularly on the first day. Many drillers used the first-day production numbers, which some of them enhanced in various ways, in their investor materials. Investors drooled and threw more money at these companies that then drilled this money into the ground.

But the impressive initial production soon declines sharply. Two years later, only a fraction is coming out of the ground. So these companies had to drill more just to cover up the decline rates, and in order to drill more, they needed to borrow more money, and it triggered a junk-rated energy boom on Wall Street.

At the time, the price of natural gas was soaring. It hit $13 per million Btu at the Henry Hub in June 2008. About 1,600 rigs were drilling for gas. It was the game in town. And Wall Street firms were greasing it with other people’s money. Production soared. And the US became the largest gas producer in the world.

But then the price began to plunge. It recovered a little after the Financial Crisis but re-plunged during the gas “glut.” By April 2012, natural gas had crashed 85% from June 2008, to $1.92/mmBtu. With the exception of a few short periods, it has remained below $4/mmBtu – trading at $2.91/mmBtu today.

Throughout, gas drillers had to go back to Wall Street to borrow more money to feed the fracking orgy. They were cash-flow negative. They lost money on wells that produced mostly dry gas. Yet they kept up the charade. They aced investor presentations with fancy charts. They raved about new technologies that were performing miracles and bringing down costs. The theme was that they would make their investors rich at these gas prices.

Read the entire article

West Texas Intermediate had been experiencing its biggest weekly plunge since January, trading at just above $42 a barrel, a new low in the current oil bust. When the Fed released its magic words, WTI soared to $45.34 a barrel before re-sagging some. Even natural gas rose 1.8%. Energy related bonds had been drowning in red ink; they too rose when oil roared higher. It was one heck of a party.

But it was too late for some players mired in the oil and gas bust where the series of Chapter 11 bankruptcy filings continues. Next in line was Quicksilver Resources.

It had focused on producing natural gas. Natural gas was where the fracking boom got started. Fracking has a special characteristic. After a well is fracked, it produces a terrific surge of hydrocarbons during first few months, and particularly on the first day. Many drillers used the first-day production numbers, which some of them enhanced in various ways, in their investor materials. Investors drooled and threw more money at these companies that then drilled this money into the ground.

But the impressive initial production soon declines sharply. Two years later, only a fraction is coming out of the ground. So these companies had to drill more just to cover up the decline rates, and in order to drill more, they needed to borrow more money, and it triggered a junk-rated energy boom on Wall Street.

At the time, the price of natural gas was soaring. It hit $13 per million Btu at the Henry Hub in June 2008. About 1,600 rigs were drilling for gas. It was the game in town. And Wall Street firms were greasing it with other people’s money. Production soared. And the US became the largest gas producer in the world.

But then the price began to plunge. It recovered a little after the Financial Crisis but re-plunged during the gas “glut.” By April 2012, natural gas had crashed 85% from June 2008, to $1.92/mmBtu. With the exception of a few short periods, it has remained below $4/mmBtu – trading at $2.91/mmBtu today.

Throughout, gas drillers had to go back to Wall Street to borrow more money to feed the fracking orgy. They were cash-flow negative. They lost money on wells that produced mostly dry gas. Yet they kept up the charade. They aced investor presentations with fancy charts. They raved about new technologies that were performing miracles and bringing down costs. The theme was that they would make their investors rich at these gas prices.

Read the entire article

March 19, 2015

Real Reason for the Asian Investment Bank – and Western Participation

Dominant Social Theme: Asia will show the West how to run an investment bank.

Free-Market Analysis: High finance and international politics are subtle affairs.

On its surface, the effort to create an Asian-oriented "world bank" is straightforward. But beneath the surface, currents swirl. The putative reason for such a bank is that the current World Bank is often exploitative and takes advantage of countries in trouble. A second reason is that the advantages of a World Bank will now accrue to Asian members. Their influence and monetary power will expand accordingly.

But the third reason is the most interesting of all. A little more from the article, first:

The concerted move to participate in Beijing's flagship economic outreach project was a diplomatic blow to the United States, reflecting European eagerness to partner with China's fast-growing economy, the world's second largest.

It comes amid prickly trade negotiations between Brussels and Washington, and at a time when EU and Asian governments are frustrated that the U.S. Congress has held up a reform of voting rights in the International Monetary Fund due to give China and other emerging powers more say in global economic governance.

German Finance Minister Wolfgang Schaeuble made the announcement at a joint news conference with visiting Chinese Vice Premier Ma Kai, at which no questions were allowed. He said Germany, Europe's biggest economy and a major trade partner of Beijing, would be a founding member of the Asian Infrastructure Investment Bank.

Read the entire article

Free-Market Analysis: High finance and international politics are subtle affairs.

On its surface, the effort to create an Asian-oriented "world bank" is straightforward. But beneath the surface, currents swirl. The putative reason for such a bank is that the current World Bank is often exploitative and takes advantage of countries in trouble. A second reason is that the advantages of a World Bank will now accrue to Asian members. Their influence and monetary power will expand accordingly.

But the third reason is the most interesting of all. A little more from the article, first:

The concerted move to participate in Beijing's flagship economic outreach project was a diplomatic blow to the United States, reflecting European eagerness to partner with China's fast-growing economy, the world's second largest.

It comes amid prickly trade negotiations between Brussels and Washington, and at a time when EU and Asian governments are frustrated that the U.S. Congress has held up a reform of voting rights in the International Monetary Fund due to give China and other emerging powers more say in global economic governance.

German Finance Minister Wolfgang Schaeuble made the announcement at a joint news conference with visiting Chinese Vice Premier Ma Kai, at which no questions were allowed. He said Germany, Europe's biggest economy and a major trade partner of Beijing, would be a founding member of the Asian Infrastructure Investment Bank.

Read the entire article

March 18, 2015

Nomi Prins: The Volatility/Quantitative Easing Dance of Doom

The battle between the ‘haves’ and ‘have-nots’ of global financial policy is escalating to the point where the ‘haves’ might start to sweat – a tiny little. This phase of heightened volatility in the markets is a harbinger of the inevitable meltdown that will follow the grand plastering-over of a systemically fraudulent global financial system. It’s like a sputtering gas tank signaling an approach to ‘empty’.

Obscene amounts of central bank liquidity applauded by government leaders that have protected the political-financial establishment with failed oversight and lack of foresight, have coalesced to form one of the most unequal, unstable economic environments in modern history. The ongoing availability of cheap capital for big bank solvency, growth and leverage purposes, as well as stock and bond market propulsion has fostered a false sense of economic security that bares little resemblance to most personal realities.

We are entering the seventh year of US initiated zero-interest-rate policy. Biblically, Joseph only gathered wheat for seven years before seven years of famine. Quantitative easing, or central bank bond buying from banks and the governments that sustain them, has enjoyed its longest period of existence ever. If these policies were about fortifying economic conditions from the ground up, fostering equality as a force for future stability, they would have worked by now. We would have moved on from them sooner.

But they aren’t. Never were. Never will be. They were designed to aid big banks and capital markets, to provide cover to feeble leadership. They are policies of capital creation, dispersion and global reallocation. The markets have acted accordingly.

What began with the US Federal Reserve became a global phenomenon of subsidizing the financial system and its largest players. Most real people – that don’t run hedge funds or big banks or leverage other peoples’ money in esoteric derivatives trades – have their own meager fortunes at risk. They don’t have the power of ECB head, Mario Draghi to issue the ‘buy’ order from atop the ECB mountain. Nor do they reap the benefits.

Retail sales are down because people have no extra money and can’t take on excess debt through credit cards forever. They aren’t governments or central banks that can print when they want to, or big private banks that can summon such assistance at will.

March 16, 2015

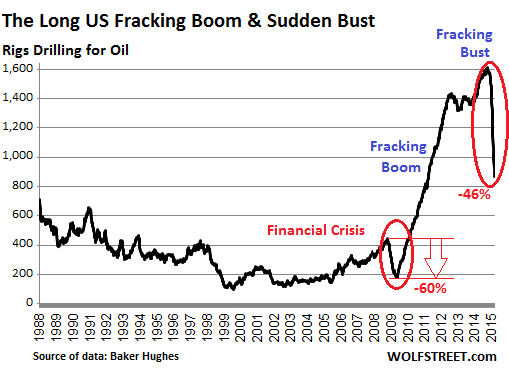

The US Oil Bust Just Got Worse

The price of oil did today what it has been doing for a while: it waits for a trigger and plunges. As I’m writing this, West Texas Intermediate is down 4.4%, trading at $44.99 a barrel, less than a measly buck away from this oil bust’s January low. It’s down over 20% from the peak of the most recent sucker rally.

US oil drillers have been responding by slashing capital expenditures, including drilling, in a deceptively brutal manner. In the latest week, drillers idled 56 rigs that were classified as drilling for oil, according to Baker Hughes. Only 866 rigs were still active, down 46.2% from October, when they’d peaked at 1,609. In the 22 weeks since, drillers have taken out 743 rigs, the most dizzying cliff dive in the data series, and probably in history:

Read the entire article

March 13, 2015

The Endless Hopelessness of a Crushing Debt Contraction – and What to Do About It

Only mass default will end the world's addiction to debt ... As global debt rises off the scale, creditors stand to take a huge hit in a threatened tsunami of defaults. – UK Telegraph

Dominant Social Theme: This will end badly as it has to.

Free-Market Analysis: This is another one of those hopeless articles that the mainstream media specializes in. There's nothing about it that provides any action points. You can understand what is going to happen but you can't do anything about it.

This is a specialty of the so-called sophisticated business media – of the mainstream kind. They'll give you a better sense of reality but they won't provide you any solutions.

Read the entire article

Dominant Social Theme: This will end badly as it has to.

Free-Market Analysis: This is another one of those hopeless articles that the mainstream media specializes in. There's nothing about it that provides any action points. You can understand what is going to happen but you can't do anything about it.

This is a specialty of the so-called sophisticated business media – of the mainstream kind. They'll give you a better sense of reality but they won't provide you any solutions.

Read the entire article

March 12, 2015

China's Latest Spinning Plate: 10 Trillion In Local Government Debt

Over the past week, we’ve noted (twice) that Chinese QE is now practically inevitable. We learned recently that corporations’ FX deposits rose by some $45 billion in January which, remarkably, represents nearly half of the entire increase logged in 2014. This points to capital flight, as both companies and individuals are increasingly reluctant to hold the yuan in the face of slowing economic growth and the growing perception that devaluation is imminent. We also pointed out that despite the PBoC’s alleged interventions (evidence of which can be found in the data on the change in FI’s position for FX purchases), the yuan is still overvalued on a REER basis, meaning, to quote Barclays, “amid slowing inflation and rising outflows, the costs of limiting CNY weakness are growing – including the unintended effect of placing more stress on CNY market liquidity and interest rates, rendering liquidity easing efforts less effective.” China then, finds itself in a rather precarious position:

Against this backdrop, we got even more evidence today that the Chinese economic slowdown may be accelerating as industrial production, retail sales, and FAI all came in light of expectations prompting us to ask (again), “just how much longer do we have to wait until the inevitable moment when the last marginal central bank joins the global currency war and starts "printing money" on its own, finally pushing the world over to the next escalation level in the "[insert noun] wars" chain?”

To be sure, the Chinese Ministry of Finance isn’t too keen on “groundless” QE rumors and had the following to say overnight on the subject:

It seems as though one way to address the issue would be for the PBoC to simply purchase a portion of the local debt pile and we wonder if indeed this will ultimately be the form that QE will take in China. Here’s UBS with more:

We’ll leave you with what we said last week regarding the QE end game:

Ultimately, this led us to conclude that “the flowchart for what is in store for the world for the next 12-24 months [looks like this]: an ongoing deterioration in Chinese economic conditions, coupled with a weaker, but not weak enough, currency, before the PBOC first go to ZIRP, and then engages in outright QE".Excessive devaluation at a time when corporates are increasingly choosing to hold their export profits in currencies other than the yuan may hasten capital outflows. The irony of course is that failing to act aggressively to arrest REER appreciation risks cutting into those very same profits or, as we put it previously, “devalue too much, and the capital outflows will accelerate, not devalue enough, and the mercantilist economy gets it.”

Against this backdrop, we got even more evidence today that the Chinese economic slowdown may be accelerating as industrial production, retail sales, and FAI all came in light of expectations prompting us to ask (again), “just how much longer do we have to wait until the inevitable moment when the last marginal central bank joins the global currency war and starts "printing money" on its own, finally pushing the world over to the next escalation level in the "[insert noun] wars" chain?”

To be sure, the Chinese Ministry of Finance isn’t too keen on “groundless” QE rumors and had the following to say overnight on the subject:

- MOF'S ZHU GUANGYAO SAYS TALKS OF CHINA `QE' GROUNDLESS

- CHINA MOF OFFICIAL SAYS NO SUCH THING AS CHINA QE: SEC. JOURNAL

While this raises a number of questions (including whether creditors will be railroaded into participating and thus forced to accept much lower rates of return), the most important thing to note here is that the swaps account for but a small percentage of total local government debt, which the following chart shows:To begin with, local governments will be allowed to swap 1 trillion yuan ($160 billion) of their existing high-interest debts for lower-cost bonds. According to the Economic Observer, a credible local newspaper, this may just be the first tranche, with the finance ministry preparing to give local governments a 3 trillion yuan quota for refinancing. It is easy to imagine that such quotas will become a regular feature of China’s fiscal landscape over the next few years. As this chart shows, the combination of new debt issuance plus swaps will help cover what local governments owe this year, but will make only a small debt in their overall liabilities…

China’s local-government debt problem has always been twofold. First, there is the sheer amount of money they owe. That has doubled from less than 20% of GDP in 2007 to nearly 40% today. Second, there is the very peculiar and opaque structure of these liabilities. Because local governments can only borrow with the explicit permission of the finance ministry, which has been miserly in the past, they have been forced to use off-balance-sheet entities to raise funds. Those entities (commonly known as local government financing vehicles, or LGFVs) have borrowed from banks and shadow banks alike. As a result, the size of their debts is unclear, but it is certain that the cost of their debts is much higher than would have been the case had they issued bonds in the first place.

It seems as though one way to address the issue would be for the PBoC to simply purchase a portion of the local debt pile and we wonder if indeed this will ultimately be the form that QE will take in China. Here’s UBS with more:

It looks as though our prediction of outright debt monetization in China may be proven correct sooner than even we thought thanks to the trillions in loans the Chinese shadow banking complex has made to the country’s local governments who desperately need some manner of relief lest the 500bps over treasurys they’re paying should end up swallowing them all whole. We also wonder what’s next for Chinese stocks in the event “real” QE is introduced given that QE-lite (PSL) resulted in the following:Chinese domestic media citing "sources" saying that the authorities are considering a Chinese "QE" with the central bank funding the purchase of RMB 10 trillion in local government debt. In fact, the "sources" seem to be some brokerage research reports speculating ways of addressing the stock of local government debt, following the MOF announcement that local governments have been given a RMB 1 trillion quota to issue bonds to replace other forms of local debt.

The current central bank law in China prohibits direct monetization of government deficit. As we have written in "China unveils local government debt solutions" last October following the government's announcement, China is likely to swap existing debt stock with bonds that have longer maturity and lower yields. Further, we wrote that such replacement bonds could mount to RMB 1 trillion, which is in line with MOF announcement over the past weekend. In addition, we think the government will consider allowing private placement of local bonds or similar means to directly swap bank loans into local government bonds (without changing debtor or creditor), which would allow for much larger debt restructuring, helping to lower local government debt service payment, and at the same time improve banks' liquidity and capital position.

We’ll leave you with what we said last week regarding the QE end game:

SourceAnd once China, that final quasi-Western nation, proceeds to engage in outright monetization of its debt, then and only then will the terminal phase of the global currency wars start: a phase which will, because global economic growth and that all important lifeblood of a globalized economy - trade - at that point will be zero if not negative, will see an unprecedented crescendo of money printing by absolutely everyone, before coordinated devaluations mutate into uncoordinated, and when central bank actions morph from "all for one" to "each man for himself."

At that moment, what had been merely currency "war" will finally transform into a shooting one.

March 11, 2015

Next Mega-Bailout On Deck: White House Studying "New Bankruptcy Options" For Student-Loan Borrowers

A quick reminder of what the biggest debt bubble currently facing America's population is.

Why is this a problem? Because as the TBAC revealed a few months back, the default risk from the $1 trillions in student loans is several orders of magnitude above the 9% student loans which the Fed has revealed as currently "in default", as one has to add those 12% of loans in deferment and 11% in forbearance to the entire risk pool. In short: a third of all student loans are likely to end up unrepaid!

And, the punchline: according to the TBAC's worst case scenario of the future of student debt, this gargantuan load will triple over the next decade, to as much as $3.3 trillion by 2024.

And, the punchline: according to the TBAC's worst case scenario of the future of student debt, this gargantuan load will triple over the next decade, to as much as $3.3 trillion by 2024.

This means that up to $1 trillion, and likely more, in household debt will go "bad" over the next decade. The problem: student debt is not dischargeable in a personal bankruptcy.

This means that up to $1 trillion, and likely more, in household debt will go "bad" over the next decade. The problem: student debt is not dischargeable in a personal bankruptcy.

That is about to change.

It appears that just as the administration is finally figuring out what HFT is, it also decided to take a look at the charts above and has made a decision: the next bailout is about to be unveiled, and it will involve a "streamlined" bankruptcy law allowing students to discharge their student debt.

Moments ago this hit the wires via Dow Jones:

And since there is no such thing as a free lunch, it will be the US taxpayer who will as usual end up footing the bill. Expect college fees to go vertical once deans and administrators understand that they can charge anything and the taxpayer will end up footing the bill.

* * *

One can read the Fact Seet on the "Student Aid Bill of Rights: Taking Action to Ensure Strong Consumer Protections for Student Loan Borrowers" below:

Source

Why is this a problem? Because as the TBAC revealed a few months back, the default risk from the $1 trillions in student loans is several orders of magnitude above the 9% student loans which the Fed has revealed as currently "in default", as one has to add those 12% of loans in deferment and 11% in forbearance to the entire risk pool. In short: a third of all student loans are likely to end up unrepaid!

That is about to change.

It appears that just as the administration is finally figuring out what HFT is, it also decided to take a look at the charts above and has made a decision: the next bailout is about to be unveiled, and it will involve a "streamlined" bankruptcy law allowing students to discharge their student debt.

Moments ago this hit the wires via Dow Jones:

- WHITE HOUSE STUDYING NEW BANKRUPTCY OPTIONS FOR STUDENT-LOAN BORROWERS

- CURRENT U.S. LAW LARGELY PROHIBITS FEDERAL, PRIVATE LOANS FROM BEING DISCHARGED IN BANKRUPTCY

Which can only mean one thing: the appointment of a Student Loan Czar is imminent, as it the "discharge" of tens if not hundreds of billions in debt, which would never be repaid in any case.President Barack Obama is slated to speak to students at Georgia Tech on Tuesday about how he wants to make the process of repaying student loans easier to understand and manage. Obama will sign a student aid bill of rights and will speak about an assortment of policy tweaks and projects to try to make it easier to help people with student loans pay back their debt.

"It's our responsibility to make sure that the 40 million Americans with student loans are aware of resources to manage their debt, and that we are doing everything we can to be responsive to their needs," said Ted Mitchell, undersecretary of education, on a conference call with reporters.

More than 70 percent of U.S. students who graduate with a bachelor's degree leave with debt, which averages $28,400.

The White House said it will require clearer disclosures from companies to make sure borrowers understand who is servicing their loan and how to set monthly payments and change repayment plans.

"Repayment rates improve when servicers work well and work directly with borrowers, helping them understand the terms of their loans," said Sarah Bloom Raskin, deputy secretary of the Treasury Department, on the conference call.

Obama will direct his Education Department to create a system by July 1, 2016 to better oversee and address complaints from borrowers about lenders, servicers and collection agencies, the White House said.

His administration will also study whether it needs to propose changes to laws or regulations to create stronger consumer protections, the White House said.

And since there is no such thing as a free lunch, it will be the US taxpayer who will as usual end up footing the bill. Expect college fees to go vertical once deans and administrators understand that they can charge anything and the taxpayer will end up footing the bill.

* * *

One can read the Fact Seet on the "Student Aid Bill of Rights: Taking Action to Ensure Strong Consumer Protections for Student Loan Borrowers" below:

The full fact sheet here.Higher education continues to be the single most important investment students can make in their own futures. Five years ago this month, President Obama signed student loan reform into law, redirecting tens of billions of dollars in bank subsidies into student aid. His historic investments in college affordability include increasing the maximum Pell Grant by $1,000, creating the American Opportunity Tax Credit worth up to $10,000 over four years of college, and letting borrowers cap their student loan payments at 10 percent of income. He has also promoted innovation and competition to help colleges reduce costs and improve quality and completion, including a First in the World fund. While these investments have helped millions of students afford college, student loans continue to grow.

That is why, today, President Obama will underscore his vision for an affordable, quality education for all Americans in a Student Aid Bill of Rights. As part of this vision, the President will sign a Presidential Memorandum directing the Department of Education and other federal agencies to work across the federal government to do more to help borrowers afford their monthly loan payments including: (1) a state-of-the-art complaint system to ensure quality service and accountability for the Department of Education, its contractors, and colleges, (2) a series of steps to help students responsibly repay their loans including help setting affordable monthly payments, and (3) new steps to analyze student debt trends and recommend legislative and regulatory changes. In addition, the Administration is releasing state by state data that shows the outstanding federal student loan balance and total number of federal student loan borrowers who stand to benefit from these actions.

A Student Aid Bill of Rights

Today’s Actions to Promote Affordable Loan Payments

- Every student deserves access to a quality, affordable education at a college that’s cutting costs and increasing learning.

- Every student should be able to access the resources needed to pay for college.

- Every borrower has the right to an affordable repayment plan.

- And every borrower has the right to quality customer service, reliable information, and fair treatment, even if they struggle to repay their loans.

Americans are increasingly reliant on student loans to help pay for college. Today, more than 70 percent of those earning a bachelor’s degree graduate with debt, which averages $28,400 at public and non-profit colleges. Today’s actions will help borrowers responsibly manage their debt, improve federal student loan servicing, and protect taxpayers’ investments in the student aid program:

Help Borrowers Afford Their Monthly Payments: The President will announce a series of steps to improve customer services and help borrowers repay their direct student loans, which are made with federal capital and administered by the Department of Education through performance-based contracts. High-quality, borrower-focused servicing helps more borrowers successfully repay their federal student loans. Building on the stronger performance incentives put in place last year, the Department will now raise the bar by:

In addition, new requirements may be appropriate for private and federally guaranteed student loans so that all of the more than 40 million Americans with student loans have additional basic rights and protections. The President is directing his Cabinet and White House advisers, working with the Consumer Financial Protection Bureau, to study whether consumer protections recently applied to mortgages and credit cards, such as notice and grace periods after loans are transferred among lenders and a requirement that lenders confirm balances to allow borrowers to pay off the loan, should also be afforded to student loan borrowers and improve the quality of servicing for all types of student loans. The agencies will develop recommendations for regulatory and legislative changes for all student loan borrowers, including possible changes to the treatment of loans in bankruptcy proceedings and when they were borrowed under fraudulent circumstances.

- Requiring enhanced disclosures and stronger consumer protections throughout the repayment process, including when federal student loans are transferred from one servicer to another, when borrowers fall behind in their payments, and when borrowers begin but do not complete applications to change repayment plans. These steps will better protect borrowers from falling behind in their payments and ensure consistency across loan servicers.

- Ensuring that its contractors apply prepayments first to loans with the highest interest rates unless the borrower requests a different allocation.

- Establishing a centralized point of access for all federal student loan borrowers in repayment to access account and payment processing information for all Federal student loan servicing contractors.

- Ensuring fair treatment for struggling and distressed borrowers by raising standards for student loan debt collectors to ensure that they charge borrowers reasonable fees and help them return to good standing; clarifying the rights of Federal student loan borrowers in bankruptcy; working with the Department of Treasury to simplify the process to verify income and keep borrowers enrolled in income-driven repayment plans; and working with the Social Security Administration to ensure that disability insurance recipients who can discharge their student loans are not instead seeing their disability payments garnished to repay defaulted loans.

Source

March 10, 2015

7 Signs That A Stock Market Peak Is Happening Right Now

Is this the end of the last great run for the U.S. stock market? Are we witnessing classic “peaking behavior” that is similar to what occurred just before other major stock market crashes? Throughout 2014 and for the early stages of 2015, stocks have been on quite a tear. Even though the overall U.S. economy continues to be deeply troubled, we have seen the Dow, the S&P 500 and the Nasdaq set record after record. But no bull market lasts forever – particularly one that has no relation to economic reality whatsoever. This false bubble of financial prosperity has been enjoyable, and even I wish that it could last much longer. But there comes a time when we all must face reality, and the cold, hard facts are telling us that this party is about to end. The following are 7 signs that a stock market peak is happening right now…

#1 Just before a stock market crash, price/earnings ratios tend to spike, and that is precisely what we are witnessing. The following commentary and chart come from Lance Roberts…

#2 The average bull market lasts for approximately 3.8 years. The current bull market has already lasted for six years.

#3 The median total gain during a bull market is 101.5 percent. For this bull market, it has been 213 percent.

#4 Usually before a stock market crash we see a divergence between the relative strength index and the stock market itself. This happened prior to the bursting of the dotcom bubble, it happened prior to the crash of 2008, and it is happening again right now…

#6 As I have discussed previously, we usually witness a spike in 10 year Treasury yields just about the time that the stock market is peaking right before a crash.

Well, according to Business Insider, we just saw the largest 5 week rate rally in two decades…

Well, the truth is that nobody knows for certain.

It could happen this week, or it could be six months from now.

In fact, a whole lot of people are starting to point to the second half of 2015 as a danger zone. For example, just consider the words of David Morgan…

But without a doubt, lots of economic warning signs are starting to pop up.

One that is particularly troubling is the decline in new orders for consumer goods. This is something that Charles Hugh-Smith pointed out in one of his recent articles…

To me, it very much appears that time is running out for this bubble of false prosperity that we have been living in.

But what do you think? Please feel free to contribute to the discussion by posting a comment below…

Source

#1 Just before a stock market crash, price/earnings ratios tend to spike, and that is precisely what we are witnessing. The following commentary and chart come from Lance Roberts…

The chart below shows Dr. Robert Shiller’s cyclically adjusted P/E ratio. The problem is that current valuations only appear cheap when compared to the peak in 2000. In order to put valuations into perspective, I have capped P/E’s at 30x trailing earnings. The dashed orange line measures 23x earnings which has been the level where secular bull markets have previously ended. I have noted the peak valuations in periods that have exceeded that 30x earnings.

At 27.85x current earning the markets are currently at valuation levels where previous bull markets have ended rather than continued. Furthermore, the markets have exceeded the pre-financial crisis peak of 27.65x earnings. If earnings continue to deteriorate, market valuations could rise rapidly even if prices remain stagnant.

#2 The average bull market lasts for approximately 3.8 years. The current bull market has already lasted for six years.

#3 The median total gain during a bull market is 101.5 percent. For this bull market, it has been 213 percent.

#4 Usually before a stock market crash we see a divergence between the relative strength index and the stock market itself. This happened prior to the bursting of the dotcom bubble, it happened prior to the crash of 2008, and it is happening again right now…

The first technical warning sign that we should heed is marked by a significant divergence between the relative strength index (RSI) and the market itself. This is noted by a declining pattern of lower highs in the RSI as stocks continue to make higher highs, a sign that the market is “topping out”. In the late ‘90s this divergence persisted for many years as the tech bubble reached epic valuation levels. In 2007 this divergence lasted over a much shorter period (6 months) before the market finally peaked and succumbed to massive selling. With last month’s strong rally to new records, we now have a confirmed divergence between the long-term relative strength index and the market’s price action.#5 In the past, peaks in margin debt have been very closely associated with stock market peaks. The following chart comes from Doug Short, and I included it in a previous article…

#6 As I have discussed previously, we usually witness a spike in 10 year Treasury yields just about the time that the stock market is peaking right before a crash.

Well, according to Business Insider, we just saw the largest 5 week rate rally in two decades…

Lots of guys and gals went home this past weekend thinking about the implications of the recent rise in the 10-year Treasury bond’s yield.#7 A lot of momentum indicators seem to be telling us that we are rapidly approaching a turning point for stocks. For example, James Stack, the editor of InvesTech Research, says that the Coppock Guide is warning us of “an impending bear market on the not-too-distant horizon”…

Chris Kimble notes it was the biggest 5-week rate rally in twenty years!

A momentum indicator dubbed the Coppock Guide, which serves as “a barometer of the market’s emotional state,” has also peaked, Stack says. The indicator, which, “tracks the ebb and flow of equity markets from one psychological extreme to another,” is also flashing a warning flag.

The Coppock Guide’s chart pattern is flashing a “double top,” which suggests that “psychological excesses are present” and that “secondary momentum has peaked” in this bull market, according to Stack.

“All of this is just another reason for concern about an impending bear market on the not-too-distant horizon,” Stack writes.So if we are to see a stock market crash soon, when will it happen?

Well, the truth is that nobody knows for certain.

It could happen this week, or it could be six months from now.

In fact, a whole lot of people are starting to point to the second half of 2015 as a danger zone. For example, just consider the words of David Morgan…

“Momentum is one indicator and the money supply. Also, when I made my forecast, there is a big seasonality, and part of it is strict analytical detail and part of it is being in this market for 40 years. I got a pretty good idea of what is going on out there and the feedback I get. . . . I’m in Europe, I’m in Asia, I’m in South America, I’m in Mexico, I’m in Canada; and so, I get a global feel, if you will, for what people are really thinking and really dealing with. It’s like a barometer reading, and I feel there are more and more tensions all the time and less and less solutions. It’s a fundamental take on how fed up people are on a global basis. Based on that, it seems to me as I said in the January issue of the Morgan Report, September is going to be the point where people have had it.”Time will tell if Morgan was right.

But without a doubt, lots of economic warning signs are starting to pop up.

One that is particularly troubling is the decline in new orders for consumer goods. This is something that Charles Hugh-Smith pointed out in one of his recent articles…

The financial news is astonishingly rosy: record trade surpluses in China, positive surprises in Europe, the best run of new jobs added to the U.S. economy since the go-go 1990s, and the gift that keeps on giving to consumers everywhere, low oil prices.

So if everything is so fantastic, why are new orders cratering? New orders are a snapshot of future demand, as opposed to current retail sales or orders that have been delivered.Posted below is a chart that he included with his recent article. As you can see, the only time things have been worse in recent decades was during the depths of the last financial crisis…

To me, it very much appears that time is running out for this bubble of false prosperity that we have been living in.

But what do you think? Please feel free to contribute to the discussion by posting a comment below…

Source

March 9, 2015

Don’t Be Fooled by the Federal Reserve’s Anti-Audit Propaganda

In recent weeks, the Federal Reserve and its apologists in Congress and the media have launched numerous attacks on the Audit the Fed legislation. These attacks amount to nothing more than distortions about the effects and intent of the audit bill.

Fed apologists continue to claim that the Audit the Fed bill will somehow limit the Federal Reserve's independence. Yet neither Federal Reserve Chair Janet Yellen nor any other opponent of the audit bill has ever been able to identify any provision of the bill giving Congress power to dictate monetary policy. The only way this argument makes sense is if the simple act of increasing transparency somehow infringes on the Fed's independence.

This argument is also flawed since the Federal Reserve has never been independent from political pressure. As economists Daniel Smith and Peter Boettke put it in their paper "An Episodic History of Modern Fed Independence," the Federal Reserve "regularly accommodates debt, succumbs to political pressures, and follows bureaucratic tendencies, compromising the Fed's operational independence."

The most infamous example of a Federal Reserve chair bowing to political pressure is the way Federal Reserve Chairman Arthur Burns tailored monetary policy to accommodate President Richard Nixon's demands for low interest rates. Nixon and Burns were even recorded mocking the idea of Federal Reserve independence.

Nixon is not the only president to pressure a Federal Reserve chair to tailor monetary policy to the president's political needs. In the fifties, President Dwight Eisenhower pressured Fed Chairman William Martin to either resign or increase the money supply. Martin eventually gave in to Ike's wishes for cheap money. During the nineties, Alan Greenspan was accused by many political and financial experts – including then-Federal Reserve Board Member Alan Blinder – of tailoring Federal Reserve policies to help President Bill Clinton.

Some Federal Reserve apologists make the contradictory claim that the audit bill is not only dangerous, but it is also unnecessary since the Fed is already audited. It is true that the Federal Reserve is subject to some limited financial audits, but these audits only reveal the amount of assets on the Fed's balance sheets. The Audit the Fed bill will reveal what was purchased, when it was acquired, and why it was acquired.

Perhaps the real reason the Federal Reserve fears a full audit can be revealed by examining the one-time audit of the Federal Reserve's response to the financial crisis authorized by the Dodd-Frank law. This audit found that between 2007 and 2010 the Federal Reserve committed over $16 trillion – more than four times the annual budget of the United States – to foreign central banks and politically influential private companies. Can anyone doubt a full audit would show similar instances of the Fed acting to benefit the political and economic elites?

Some fed apologists are claiming that the audit bill is part of a conspiracy to end the Fed. As the author of a book called End the Fed, I find it laughable to suggest that I, and other audit supporters, are hiding our true agenda. Besides, how could an audit advance efforts to end the Fed unless the audit would prove that the American people would be better off without the Fed? And don't the people have a right to know if they are being harmed by the current monetary system?

For over a century, the Federal Reserve has operated in secrecy, to the benefit of the elites and the detriment of the people. It is time to finally bring transparency to monetary policy by auditing the Federal Reserve.

Source

Fed apologists continue to claim that the Audit the Fed bill will somehow limit the Federal Reserve's independence. Yet neither Federal Reserve Chair Janet Yellen nor any other opponent of the audit bill has ever been able to identify any provision of the bill giving Congress power to dictate monetary policy. The only way this argument makes sense is if the simple act of increasing transparency somehow infringes on the Fed's independence.

This argument is also flawed since the Federal Reserve has never been independent from political pressure. As economists Daniel Smith and Peter Boettke put it in their paper "An Episodic History of Modern Fed Independence," the Federal Reserve "regularly accommodates debt, succumbs to political pressures, and follows bureaucratic tendencies, compromising the Fed's operational independence."

The most infamous example of a Federal Reserve chair bowing to political pressure is the way Federal Reserve Chairman Arthur Burns tailored monetary policy to accommodate President Richard Nixon's demands for low interest rates. Nixon and Burns were even recorded mocking the idea of Federal Reserve independence.

Nixon is not the only president to pressure a Federal Reserve chair to tailor monetary policy to the president's political needs. In the fifties, President Dwight Eisenhower pressured Fed Chairman William Martin to either resign or increase the money supply. Martin eventually gave in to Ike's wishes for cheap money. During the nineties, Alan Greenspan was accused by many political and financial experts – including then-Federal Reserve Board Member Alan Blinder – of tailoring Federal Reserve policies to help President Bill Clinton.

Some Federal Reserve apologists make the contradictory claim that the audit bill is not only dangerous, but it is also unnecessary since the Fed is already audited. It is true that the Federal Reserve is subject to some limited financial audits, but these audits only reveal the amount of assets on the Fed's balance sheets. The Audit the Fed bill will reveal what was purchased, when it was acquired, and why it was acquired.

Perhaps the real reason the Federal Reserve fears a full audit can be revealed by examining the one-time audit of the Federal Reserve's response to the financial crisis authorized by the Dodd-Frank law. This audit found that between 2007 and 2010 the Federal Reserve committed over $16 trillion – more than four times the annual budget of the United States – to foreign central banks and politically influential private companies. Can anyone doubt a full audit would show similar instances of the Fed acting to benefit the political and economic elites?

Some fed apologists are claiming that the audit bill is part of a conspiracy to end the Fed. As the author of a book called End the Fed, I find it laughable to suggest that I, and other audit supporters, are hiding our true agenda. Besides, how could an audit advance efforts to end the Fed unless the audit would prove that the American people would be better off without the Fed? And don't the people have a right to know if they are being harmed by the current monetary system?

For over a century, the Federal Reserve has operated in secrecy, to the benefit of the elites and the detriment of the people. It is time to finally bring transparency to monetary policy by auditing the Federal Reserve.

Source

March 6, 2015

Unraveling The Mystery Of Oil And The Swiss Franc

I want to preface my article with a short excerpt from one of my favorite books,Antifragile, by Nassim Taleb:

Has the DNA of the global economy been gradually altered by endless injections of quantitative easing, morphing it into a freakish mutant? Are things that are not supposed to happen for centuries on end going to become common occurrences? The collapse of oil prices and jump in the Swiss franc have forced me to puzzle over these weighty questions. In isolation, these events and the direction of their moves did not worry me, but their magnitude, velocity and proximity to each other sent me on an intellectual quest.

Let’s start with oil. Supply has been increasing due to growth in shale oil production in the U.S., and that increase along with a stronger dollar drove oil prices lower (since oil is priced in dollars). Additionally, demand for oil has weakened in the developed markets as vehicles have become more fuel-efficient. However, none of these things are new. You can also blame the fall in oil prices on OPEC and its unwillingness to lower production, but what is now an obvious decline was not obvious six months ago. Oil prices have sunk more than 50 percent in less than five months, and this happened not during a financial crisis but in a (supposedly) stable global economy where most economies are growing.

Now let’s place these events in the context of the current environment. Ultralow global interest rates have pushed all market participants into riskier assets. For instance, investors who in the past could tolerate only the risk of high-quality, short-duration Treasury bonds are now gulping long-duration junk bonds as if they were default-free Treasuries. In addition, low interest rates are also pushing investors into using more leverage. This point is now more important than ever. Volatility and leverage are not friends. Crucially, we don’t know where all the leverage is buried and will only find out after the fact.

So far, corporate defaults are de minimis — but that won’t last forever. In other words, investors to date have only reaped the benefits of owning riskier assets but have not suffered from the “risky” part of that theme. But suffering will come, unless you believe that QE injections have miraculously modified the laws of financial gravity so that by taking more risk you simply get ever-higher returns.

If you are waiting for Wall Street economists or strategists to warn you about impending risks, don’t hold your breath — none of them were forecasting $50 oil prices a year ago. Oil production and the global economy as a whole did not fundamentally change in 2014, but oil now costs half as much as it did a year ago. The lesson we should learn from the oil price decline is that risks can develop fast in places we don’t expect them, and they may only be obvious in hindsight.

Now let’s talk about the Swiss franc, which jumped 16 percent in one day when the Swiss National Bank decided it couldn’t afford to go on losing billions of francs month after month, desperately trying to keep its currency down in relation to the euro and dollar. Instead, it opted to pass the burden of losses on to investors looking for a safe harbor in the Swiss franc, by imposing negative interest rates on deposits.

Let’s expand on this fact for a second: Today, if you buy bonds issued by the Swiss government, you’ll pay interest for the privilege of holding your hard-earned savings in the Swiss currency. Normally, governments pay you — the investor — for your consideration in investing in their bonds. But for the Swiss these are not normal times.

I cannot recall when the currency of a developed country — we’re not talking about a banana republic here; we’re talking about Switzerland — moved 16 percent in one day. (Unlike stocks, a 1 or 2 percent intraday move in a currency is considered to be a big shift.) By the way, negative interest rates are not part of the normal economics curriculum either.

Here is the lesson from this:

We are dialing down on risk even further in our stock selection; and despite the euphoria in the stock market, we are raising the bar for stocks in our portfolio — we are going medieval on quality and the margin of safety. This will cause our cash balances to increase. Cash has not been the investor’s friend — it is never a friend in a rising market. But oil prices and the Swiss franc have reminded us again that risk can spread quickly, and when you need cash it may already be too late to raise it. We are giving up some returns today for the ability to buy attractive stocks at lower prices in the near future.

Source

Our global economy and thus stock markets have experienced manufactured (not true) stability, and this is what I am puzzling about in the following article that I wrote for Institutional Investor.A turkey is fed for a thousand days by a butcher; every day confirms to its staff of analysts that butchers love turkeys “with increased statistical confidence.” The butcher will keep feeding the turkey until a few days before Thanksgiving. Then comes that day when it is really not a very good idea to be a turkey. So with the butcher surprising it, the turkey will have a revision of belief—right when its confidence in the statement that the butcher loves turkeys is maximal and “it is very quiet” and soothingly predictable in the life of the turkey.…The key here is that such a surprise will be a Black Swan event; but just for the turkey, not for the butcher….

“Not being a turkey” starts with figuring out the difference between true and manufactured stability.

(emphasis mine).

Has the DNA of the global economy been gradually altered by endless injections of quantitative easing, morphing it into a freakish mutant? Are things that are not supposed to happen for centuries on end going to become common occurrences? The collapse of oil prices and jump in the Swiss franc have forced me to puzzle over these weighty questions. In isolation, these events and the direction of their moves did not worry me, but their magnitude, velocity and proximity to each other sent me on an intellectual quest.

Let’s start with oil. Supply has been increasing due to growth in shale oil production in the U.S., and that increase along with a stronger dollar drove oil prices lower (since oil is priced in dollars). Additionally, demand for oil has weakened in the developed markets as vehicles have become more fuel-efficient. However, none of these things are new. You can also blame the fall in oil prices on OPEC and its unwillingness to lower production, but what is now an obvious decline was not obvious six months ago. Oil prices have sunk more than 50 percent in less than five months, and this happened not during a financial crisis but in a (supposedly) stable global economy where most economies are growing.

Now let’s place these events in the context of the current environment. Ultralow global interest rates have pushed all market participants into riskier assets. For instance, investors who in the past could tolerate only the risk of high-quality, short-duration Treasury bonds are now gulping long-duration junk bonds as if they were default-free Treasuries. In addition, low interest rates are also pushing investors into using more leverage. This point is now more important than ever. Volatility and leverage are not friends. Crucially, we don’t know where all the leverage is buried and will only find out after the fact.

So far, corporate defaults are de minimis — but that won’t last forever. In other words, investors to date have only reaped the benefits of owning riskier assets but have not suffered from the “risky” part of that theme. But suffering will come, unless you believe that QE injections have miraculously modified the laws of financial gravity so that by taking more risk you simply get ever-higher returns.

If you are waiting for Wall Street economists or strategists to warn you about impending risks, don’t hold your breath — none of them were forecasting $50 oil prices a year ago. Oil production and the global economy as a whole did not fundamentally change in 2014, but oil now costs half as much as it did a year ago. The lesson we should learn from the oil price decline is that risks can develop fast in places we don’t expect them, and they may only be obvious in hindsight.

Now let’s talk about the Swiss franc, which jumped 16 percent in one day when the Swiss National Bank decided it couldn’t afford to go on losing billions of francs month after month, desperately trying to keep its currency down in relation to the euro and dollar. Instead, it opted to pass the burden of losses on to investors looking for a safe harbor in the Swiss franc, by imposing negative interest rates on deposits.

Let’s expand on this fact for a second: Today, if you buy bonds issued by the Swiss government, you’ll pay interest for the privilege of holding your hard-earned savings in the Swiss currency. Normally, governments pay you — the investor — for your consideration in investing in their bonds. But for the Swiss these are not normal times.

I cannot recall when the currency of a developed country — we’re not talking about a banana republic here; we’re talking about Switzerland — moved 16 percent in one day. (Unlike stocks, a 1 or 2 percent intraday move in a currency is considered to be a big shift.) By the way, negative interest rates are not part of the normal economics curriculum either.

Here is the lesson from this:

Here’s another analogy: The arguments in favor of GMO crops are that they increase yields, decrease the need for pesticides and mitigate soil erosion. The argument against them is simple but more ambiguous: We don’t know the long-term consequences of growing and eating GMOs. It’s the same thing with QE, which is even less organic to the economy than GMOs are to the soil and the human body. We know the positives, but it is the hidden consequences, the things we don’t know, that scare me.We don’t know what the ultimate consequences of near-zero interest rates will be, but we are pretty sure their impact will be amplified by increased leverage in the system and the dangerous mismatch between risky assets and their holders. This will lead to increased volatility in places we don’t expect.

We are dialing down on risk even further in our stock selection; and despite the euphoria in the stock market, we are raising the bar for stocks in our portfolio — we are going medieval on quality and the margin of safety. This will cause our cash balances to increase. Cash has not been the investor’s friend — it is never a friend in a rising market. But oil prices and the Swiss franc have reminded us again that risk can spread quickly, and when you need cash it may already be too late to raise it. We are giving up some returns today for the ability to buy attractive stocks at lower prices in the near future.

Source

March 5, 2015

“Default Monday”: Oil & Gas Companies Face Their Creditors as the Fracking Bubble Bursts

Debt funded the fracking boom. Now oil and gas prices have collapsed, and so has the ability to service that debt. The oil bust of the 1980s took down 700 banks, including 9 of the 10 largest in Texas. But this time, it’s different. This time, bondholders are on the hook.

And these bonds – they’re called “junk bonds” for a reason – are already cracking. Busts start with small companies and proceed to larger ones. “Bankruptcy” and “restructuring” are the terms that wipe out stockholders and leave bondholders and other creditors to tussle over the scraps.

Early January, WBH Energy, a fracking outfit in Texas, kicked off the series by filing for bankruptcy protection. It listed assets and liabilities of $10 million to $50 million. Small fry.

A week later, GASFRAC filed for bankruptcy in Alberta, where it’s based, and in Texas – under Chapter 15 for cross-border bankruptcies. Not long ago, it was a highly touted IPO, whose “waterless fracking” technology would change a parched world. Instead of water, the system pumps liquid propane gel (similar to Napalm) into the ground; much of it can be recaptured, in theory.

Ironically, it went bankrupt for other reasons: operating losses, “reduced industry activity,” the inability to find a buyer that would have paid enough to bail out its creditors, and “limited access to capital markets.” The endless source of money without which fracking doesn’t work had dried up.

On February 17, Quicksilver Resources announced that it would not make a $13.6 million interest payment on its senior notes due in 2019. It invoked the possibility of filing for Chapter 11 bankruptcy to “restructure its capital structure.” Stockholders don’t have much to lose; the stock is already worthless. The question is what the creditors will get.

It has hired Houlihan Lokey Capital, Deloitte Transactions and Business Analytics, “and other advisors.” During its 30-day grace period before this turns into an outright default, it will haggle with its creditors over the “company’s options.”

On February 27, Hercules Offshore had its share-price target slashed to zero, from $4 a share, at Deutsche Bank, which finally downgraded the stock to “sell.” If you wait till Deutsche Bank tells you to sell, you’re ruined!

When I wrote about Hercules on October 15, HERO was trading at $1.47 a share, down 81% since July. Those who followed the hype to “buy the most hated stocks” that day lost another 44% by the time I wrote about it on January 16, when HERO was at $0.82 a share. Wednesday, shares closed at $0.60.

Deutsche Bank was right, if late. HERO is headed for zero (what a trip to have a stock symbol that rhymes with zero). It’s going to restructure its junk debt. Stockholders will end up holding the bag.

On Monday, due to “chronically low natural gas prices exacerbated by suddenly weaker crude oil prices,” Moody’s downgraded gas-driller Samson Resources, to Caa3, invoking “a high risk of default.”

It was the second time in two months that Moody’s downgraded the company. The tempo is picking up. Moody’s:

This is no longer small fry.

Also on Monday, oil-and-gas exploration and production company BPZ Resources announced that it would not pay $62 million in principal and interest on convertible notes that were due on March 1. It will use its grace period of 10 days on the principal and of 30 days on the interest to figure out how to approach the rest of its existence. It invoked Chapter 11 bankruptcy as one of the options.

If it fails to make the payments within the grace period, it would also automatically be in default of its 2017 convertible bonds, which would push the default to $229 million.

BPZ already tried to refinance the 2015 convertible notes in October and get some extra cash. Fracking devours prodigious amounts of cash. But there’d been no takers for the $150 million offering. Even bond fund managers, driven to sheer madness by the Fed’s policies, had lost their appetite. And its stock is worthless.