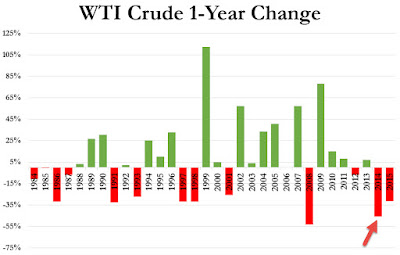

With yet another false-dawn of crude prices blowing in the wind of cash-flow generation desperation, we thought it an appropriate time for a bigger picture glance at the state of the carnage in crude...

December 31, 2015

December 30, 2015

Financial Armageddon Approaches: U.S. Banks Have 247 Trillion Dollars Of Exposure To Derivatives

Did you know that there are 5 “too big to fail” banks in the United States that each have exposure to derivatives contracts that is in excess of 30 trillion dollars? Overall, the biggest U.S. banks collectively have more than 247 trillion dollars of exposure to derivatives contracts. That is an amount of money that is more than 13 times the size of the U.S. national debt, and it is a ticking time bomb that could set off financial Armageddon at any moment. Globally, the notional value of all outstanding derivatives contracts is a staggering 552.9 trillion dollars according to the Bank for International Settlements. The bankers assure us that these financial instruments are far less risky than they sound, and that they have spread the risk around enough so that there is no way they could bring the entire system down. But that is the thing about risk – you can try to spread it around as many ways as you can, but you can never eliminate it. And when this derivatives bubble finally implodes, there won’t be enough money on the entire planet to fix it.

A lot of readers may be tempted to quit reading right now, because “derivatives” is a term that sounds quite complicated. And yes, the details of these arrangements can be immensely complicated, but the concept is quite simple. Here is a good definition of “derivatives” that comes from Investopedia…

A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. The derivative itself is a contract between two or more parties based upon the asset or assets. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes.

Read the entire article

A lot of readers may be tempted to quit reading right now, because “derivatives” is a term that sounds quite complicated. And yes, the details of these arrangements can be immensely complicated, but the concept is quite simple. Here is a good definition of “derivatives” that comes from Investopedia…

A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. The derivative itself is a contract between two or more parties based upon the asset or assets. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes.

Read the entire article

December 29, 2015

January 1, 2016: The New Bank Bail-In System Goes Into Effect In Europe

If you have a bank account anywhere in Europe, you need to read this article. On January 1st, 2016, a new bail-in system will go into effect for all European banks. This new system is based on the Cyprus bank bail-ins that we witnessed a few years ago. If you will remember, money was grabbed from anyone that had more than 100,000 euros in their bank accounts in order to bail out the banks. Now the exact same principles that were used in Cyprus are going to apply to all of Europe. And with the entire global financial system teetering on the brink of chaos, that is not good news for those that have large amounts of money stashed in shaky European banks.

Below, I have shared part of an announcement about this new bail-in system that comes directly from the official website of the European Parliament. I want you to notice that they explicitly say that “unsecured depositors would be affected last”. What they really mean is that any time a bank in Europe fails, they are going to come after private bank accounts once the shareholders and bond holders have been wiped out. So if you have more than 100,000 euros in a European bank right now, you are potentially on the hook when that bank goes under…

Read the entire articleThe directive establishes a bail-in system which will ensure that taxpayers will be last in the line to the pay the bills of a struggling bank. In a bail-in, creditors, according to a pre-defined hierarchy, forfeit some or all of their holdings to keep the bank alive. The bail-in system will apply from 1 January 2016.The bail-in tool set out in the directive would require shareholders and bond holders to take the first big hits.Unsecured depositors (over €100,000) would be affected last, in many cases even after the bank-financed resolution fund and the national deposit guarantee fund in the country where it is located have stepped in to help stabilise the bank. Smaller depositors would in any case be explicitly excluded from any bail-in.

December 28, 2015

Meanwhile, Over At The "New York" Stock Exchange... Many Lasers

The "device", as Extremetech explained in early 2014, was the AOptix IntelliMax laser (used in various US defense programs), and now generously provided by Anova to various very wealthy HFT clients - in exchange for a very generous installation and recurring monthly fee - who desired to eliminate the 0.18 millisecond microwave latency between the NYSE and Nasdaq, by going straight to laser.

High-frequency trading — the practice of making thousands of algorithmic stock trades per minute — is about to get a big boost in the USA. Anova, a company that specializes in deploying low-latency networks for stock trading, is completing an ultra-high-speed laser network between the New York Stock Exchange (NYSE) and the NASDAQ. The link will be just a few nanoseconds faster than the current microwave and fiber-optic links — but in the world of high-frequency trading (HFT), those nanoseconds could result in millions of dollars in profits for the trading companies. Such is the insanity of the stock markets; such is the unbelievable capacity of HFT to create money out of almost nothing.

If you want to get a signal quickly from point A to point B, you basically have three options: fiber-optic cables, a network of microwave dishes, or laser links. Electrical (copper wire) networks are feasible over short runs, but their reduced functionality and bandwidth over longer runs makes them less desirable than fiber. Microwave (and even higher-frequency millimeter wave) networks also aren’t very high-bandwidth, but because they’re purpose-built, they can take a very direct route, significantly undercutting the latency of an oft-congested and round-about fiber network.

Laser networks have all the advantages of microwave/millimeter wave networks, but they have higher bandwidth, and some very clever adaptive optics means they’re not impacted by bad weather. (Microwaves really hate inclement weather.)

December 25, 2015

Switzerland To Vote On Ending Fractional Reserve Banking

One year ago (and just two months before the shocking announcement the Swiss Franc's peg to the Euro would end, dramatically revaluing the currency, and leading to massive FX losses around the globe and for the Swiss National Bank) the Swiss held a referendum whether to demand that their central bank should convert 20% of its reserves into gold, up from 7% currently. After the early polls showed the Yes vote taking a surprising lead, the Diebold machines kicked in and the result was a sweeping victory for the No vote, without a single canton voting for sound money.

Ironically, this unexpected nonchallance about the Swiss central bank's balance sheet by one of Europe's more responsible nations took place just before the same bank announced CHF30 billions in losses on its long EUR positions following the revaluation of the CHF. It also took place when not just Germany, but the Netherlands and Austria announced they would repatriate a major portion of their gold in a move which, all spin aside, signals rising concerns about the existing monetary system.

We wonder if the Swiss have changed their mind about just how prudent it is to have their central bank operate as one of the world's largest - and worst - after its CHF 30 billion loss in Q1 FX traders, and hedge funds with $94 billion in stock holdings, since then.

We may soon have the answer, because in what is shaping up to be another historic referendum on the treatment of money, earlier today the Swiss Federal Government confirmed that it had received enough signatures and would hold a referendum as part of the so-called "Vollgeld", or Full Money Initiative, also known as the Campaign for Monetary Reform, which seeks to ban commercial banks from creating money, and which calls for the central bank to be given sole power to create the money in the financial system.

In other words, an initiative to ban fractional reserve banking, and revert to a 100% reserve.

December 24, 2015

58 Facts About The U.S. Economy From 2015 That Are Almost Too Crazy To Believe

The world didn’t completely fall apart in 2015, but it is undeniable that an immense amount of damage was done to the U.S. economy. This year the middle class continued to deteriorate, more Americans than ever found themselves living in poverty, and the debt bubble that we are living in expanded to absolutely ridiculous proportions. Toward the end of the year, a new global financial crisis erupted, and it threatens to completely spiral out of control as we enter 2016. Over the past six months, I have been repeatedly stressing to my readers that so many of the exact same patterns that immediately preceded the financial crisis of 2008 are happening once again, and trillions of dollars of stock market wealth has already been wiped out globally. Some of the largest economies on the entire planet such as Brazil and Canada have already plunged into deep recessions, and just about every leading indicator that you can think of is screaming that the U.S. is heading into one. So don’t be fooled by all the happy talk coming from Barack Obama and the mainstream media. When you look at the cold, hard numbers, they tell a completely different story. The following are 58 facts about the U.S. economy from 2015 that are almost too crazy to believe…

What we have seen so far is just the very small tip of a very large iceberg. About six months ago, I stated that “our problems will only be just beginning as we enter 2016″, and I stand by that prediction.

We are in the midst of a long-term economic collapse that is beginning to accelerate once again. Our economic infrastructure has been gutted, our middle class is being destroyed, Wall Street has been transformed into the biggest casino in the history of the planet, and our reckless politicians have piled up the biggest mountain of debt the world has ever seen.

December 23, 2015

IPO Window Suddenly Closes, “Worst Year Since 2009,” Worst December Since 2008

Party over: “Pent-up supply” in a world with no demand.

“We all thought that we might finally get a year where we would be able to put four quarters together,” UBS global head of equity capital markets Sam Kendall told Reuters. “If you looked at the pipeline and how people were thinking about the world, it just felt good. And then the wheels came off.”

The two measly IPOs in the US in December brought the total for the year to 170, down 38% from 2014, according to Renaissance Capital. By that measure, it was the worst year since 2012.

In terms of dollars, only $28.7 billion in IPOs were booked in the US in 2015, down 48% from 2014, and by that measure, according to Thomson Reuters, “their worst year since 2009.”

Numerous IPOs were pulled or shelved this fall due to “turbulent markets,” as it’s called. They included some LBO queens, owned by private equity firms, such as supermarket Albertson and Texas-based luxury retailer Neiman Marcus that had gotten hit by oil bust contagion [read… Retail Sales in Texas Plunge].

A number of IPOs were pushed through by lowering their IPO prices, like the erstwhile hero of the year, payments systems provider First Data, another LBO queen that KKR acquired in 2007. Initially, the IPO price range was $18 to $20. But there wasn’t enough appetite. So the IPO price was lowered to $16. That was in mid-October. On Monday, it closed at $15.60.

December 22, 2015

"I Know Of No One Who Predicted This": Russian Oil Production Hits Record As Saudi Gambit Fails

In late October, we noted that for the second time this year, Russia overtook Saudi Arabia as the biggest exporter of crude to China.

Russia also took the top spot in May, marking the first time in history that Moscow beat out Riyadh when it comes to crude exports to Beijing. “Moscow is wrestling with crippling Western economic sanctions and building closer ties with Beijing is key to mitigating the pain,” we said in October, on the way to explaining that closer ties between Russia and China as it relates to energy are part and parcel of a burgeoning relationship between the two countries who have voted together on the Security Council on matters of geopolitical significance. Here's a look at the longer-term trend:

You may also recall that Gazprom Neft (which is the number three oil producer in Russia) began settling all sales to China in yuan starting in January. This, we said, is yet another sign of the petrodollar’s imminent demise.

On Monday, we learn that for the third time in 2015, Russia has once again bested the Saudis for the top spot on China’s crude suppliers list. “Russia overtook Saudi Arabia for the third time this year in November as China's largest crude oil supplier,” Reuters writes, adding that “China brought in about 949,925 barrels per day (bpd) of Russian crude in November, compared with 886,950 bpd from Saudi Arabia.”

This is an annoyance for Riyadh. China was the world's second-largest oil consumer in 2014 and closer ties between Moscow and Beijing not only represent a threat in terms of crude revenue, but also in terms of geopolitics as the last thing the Saudis need is for Xi to begin poking around militarily in the Arabian Peninsula on behalf of Moscow and Tehran.

December 21, 2015

The Rate Hike Stock Market Crash Has Thrown Gasoline Onto An Already Raging Global Financial Inferno

If the stock market crash of last Thursday and Friday had all happened on one day, it would have been the 7th largest single day decline in U.S. history. On Friday, the Dow Jones Industrial Average was down 367 points after finishing down 253 points on Thursday. The overall decline of 620 points between the two days would have been the 7th largest single day stock market crash ever experienced in the United States if it had happened within just one trading day. If you will remember, this is precisely what I warned would happen if the Federal Reserve raised interest rates. But when news of the rate hike first came out on Wednesday, stocks initially jumped. This didn’t make any sense at all, and personally I was absolutely stunned that the markets had behaved so irrationally. But then we saw that on Thursday and Friday the markets did exactly what we thought they would do. The chief economist at Gluskin Sheff, David Rosenberg, is calling the brief rally on Wednesday “a head-fake of enormous proportions“, and analysts all over Wall Street are bracing for what could be another very challenging week ahead.

When the Federal Reserve decided to lift interest rates, they made a colossal error. You don’t raise interest rates when a global financial crisis has already started. That is absolutely suicidal. It is the kind of thing that you would do if you were trying to bring down the global financial system on purpose.

Surely the “experts” at the Federal Reserve can see what is happening. Junk bonds have already crashed, just like they did in 2008. The price of oil has crashed, just like it did in 2008. Commodity prices have crashed, just like they did in 2008. And more than half of all major global stock market indexes are already down at least 10 percent for the year so far.

December 18, 2015

The Fed’s New “Operation Twist”: Twisted Logic for Bank Profits at the Expense of the Real Economy

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets…recovery will fail unless we break the financial oligarchy that is blocking essential reform.

One could imagine a more honest case for rate increases: that sustained negative real yields promotes speculation (witness the proliferation of Silicon Valley unicorns), hurts retirees and savers, and puts the viability of long-term investors like life insurers and pension funds at risk. But given how weak this recovery is, and that deflationary pressures are strong, any rate increases should be accompanied by more fiscal spending. Yet the Fed has not said a peep on that front and instead hope the confidence fiary will come to the rescue.

The fact that the Fed is embarking on a policy that will perpetuate the financial system being outsized relative to the real economy, particularly when more and more academic studies confirm that that is negative for growth, confirms that the Fed needs fundamental governance changes to reduce bank influence and increase democratic accountability. A place to start might be having all the regional Fed presidents be nominated by the President and subject to Congressional approval.

Read the entire article

One could imagine a more honest case for rate increases: that sustained negative real yields promotes speculation (witness the proliferation of Silicon Valley unicorns), hurts retirees and savers, and puts the viability of long-term investors like life insurers and pension funds at risk. But given how weak this recovery is, and that deflationary pressures are strong, any rate increases should be accompanied by more fiscal spending. Yet the Fed has not said a peep on that front and instead hope the confidence fiary will come to the rescue.

The fact that the Fed is embarking on a policy that will perpetuate the financial system being outsized relative to the real economy, particularly when more and more academic studies confirm that that is negative for growth, confirms that the Fed needs fundamental governance changes to reduce bank influence and increase democratic accountability. A place to start might be having all the regional Fed presidents be nominated by the President and subject to Congressional approval.

Read the entire article

December 17, 2015

What The Market Chose To Ignore In Yesterday's Fed Announcement

Yesterday, in a carbon-copy response to what happened in December 2013 when the Fed announced the Tapering of QE, stocks first sold off then, as if to validate the Fed's decision as being accurate, saw a dramatic buying surge which pushed them to close just off the highs. With bonds and gold selling off while the dollar rebounded, the Fed could not have asked for - or engineered - a better reaction, while markets, as Bloomberg's Richard Breslow points out, 'chose to hear the parts of the statement and press conference that they wanted to."

That was the easy part. The hard part now is how to ween the market away from the old narrative, the one which has pushed the S&P to record highs over the past 7 years on bad economic news, and to renormalize the market's own "reaction function" to that of the Fed. The problem is that from day one there is a major discrepancy between the two: as previously observed, the Fed did not deliver the desired dovish hike, and kept its 2016 year-end fed funds rate unchanged at 1.4% suggesting 4 rate hikes in the coming year, and which as Breslow notes means "being less dovish than the meeting previews suggested is now a sign of bullishness on the economy." This sets the Fed on a collision course with the market because "with the market pricing fewer hikes than the Fed suggests, someone is going to end up being wrong. If we do get four hikes next year, markets (read equities) will need to deal with a hawkish surprise. If the Fed is forced to backtrack, there goes the full-speed ahead theme."

What this explicitly means is two things: bad economic news is no longer good for the market - after all the dominant paradigm now is one of strong dollar=strong economy=strong S&P (ignoring that the stronger the dollar, the worse the earnings recession sets up to be, the sharper the full economic recession), and that as Breslow concludes, the "Fed needs to focus on the real economy and get out of the QE mindset. I suspect that will be easier said than done."

Finally, what yesterday's hike also ignores is that as Jeffrey Gundlach explained recently, the economy is at a worse place than where it was the last time the Fed could have hiked, the industrial recession is now official, the earnings drop of the S&P500 is far more steep than it was 3 months ago, and China's renewed devaluation is signaling that it is all uphill from here from the emerging markets.

December 16, 2015

Which Corporations Own The White House

The president and his top advisers have kept an open door for CEOs of Fortune 100 companies, keeping almost 1,000 appointmentswith them, a Reuters review of White House records shows. Of the hundreds of appointments listed, Obama himself was present at about half. As the corrupting hand of government intervention spreads, so CEOs and the White House have become allies in advocating for immigration reform, the Trans-Pacific Partnership trade deal and reauthorization for the Export-Import Bank. So who really owns The White House?

December 15, 2015

Bitcoin Or Gold: Did The Alleged Bitcoin Creator Just Settle Once And For All What Is More Valuable?

Last Wednesday, we brought you the story of Craig Steven Wright who was “outed” by Wired and Gizmodo as Satoshi Nakamoto, the pseudonymous founder of bitcoin.

Hours after two articles pegged Wright as the man behind the myth, Australian authorities moved in, raiding the residence “Cold fish Craig” (as he was known in his neighborhood) rented with his wife and conducting searches and interviews at his businesses.

Apparently, Australian tax authorities had questioned Wright in the past and according to a number of sources (and documents obtained by Wired and Gizmodo), there appears to have been some manner of dispute over how his bitcoin holdings should be taxed. The attention accorded to Wright on the heels of the two articles published late last Tuesday might have prompted the ATO to move in once and for all, although authorities claimed at the time that there was no connection between the new “revelations” about Wright’s identity and the raids.

Now, we get the latest twist in what is already a fairly bizarre story, as The Australian says that in May of 2013, Wright attempted to buy some $85 million in gold and software from Mark Ferrier, who at the time was working on a deal whereby his MJF Mining would obtain 50% of the gold discovered by ASX-listed goldminer Paynes Find Gold.

Apparently, Paynes needed machinery which Ferrier - via MJF - was willing to provide in exchange for a claim on any future discoveries. According to the Australian, “Mr Ferrier is alleged to have told Mr Wright gold was good security in the event the ‘funny money’ of Bitcoin failed.” Here’s what supposedly happened next:

Read the entire article

Hours after two articles pegged Wright as the man behind the myth, Australian authorities moved in, raiding the residence “Cold fish Craig” (as he was known in his neighborhood) rented with his wife and conducting searches and interviews at his businesses.

Apparently, Australian tax authorities had questioned Wright in the past and according to a number of sources (and documents obtained by Wired and Gizmodo), there appears to have been some manner of dispute over how his bitcoin holdings should be taxed. The attention accorded to Wright on the heels of the two articles published late last Tuesday might have prompted the ATO to move in once and for all, although authorities claimed at the time that there was no connection between the new “revelations” about Wright’s identity and the raids.

Now, we get the latest twist in what is already a fairly bizarre story, as The Australian says that in May of 2013, Wright attempted to buy some $85 million in gold and software from Mark Ferrier, who at the time was working on a deal whereby his MJF Mining would obtain 50% of the gold discovered by ASX-listed goldminer Paynes Find Gold.

Apparently, Paynes needed machinery which Ferrier - via MJF - was willing to provide in exchange for a claim on any future discoveries. According to the Australian, “Mr Ferrier is alleged to have told Mr Wright gold was good security in the event the ‘funny money’ of Bitcoin failed.” Here’s what supposedly happened next:

Read the entire article

December 14, 2015

December 14th To 18th: A Week Of Reckoning For Global Stocks If The Fed Hikes Interest Rates?

Are we about to witness widespread panic in the global financial marketplace? This week is shaping up to be an absolutely critical week for global stocks. Coming into December, more than half of the 93 largest stock market indexes in the world were down more than 10 percent year to date, and last week stocks really started to slide all over the world. Here in the United States, the Dow Jones Industrial Average is down about 600 points over the past week or so, and at this point it is down more than 1000 points from the peak of the market. That brings us to this week, during which the Federal Reserve is expected to raise interest rates for the very first time since the last financial crisis. If that happens, that could potentially be enough to accelerate this “slide” into a full-blown crash.

And just look at what is already happening. Trading for stocks in the Middle East has opened for the week, and we are already witnessing tremendous carnage…

Following Friday’s further freefall in crude oil prices, The Middle East is opening down notably. Abu Dhabi, Saudi, and Kuwait are lower; Israel is weak and UAE and Qatar are tumbling, but Dubai is worst for now. Dubai is down for the 6th day in a row (dropping over 3% – the most in a month) extending the opening losses to 2-year lows. The 11% drop in the last 6 days is the largest since the post-China-devaluation global stock collapse. Leading the losses are financial and property firms.

Things in Asia look very troubling as well. As I write this, the Japanese market has just opened, and the Nikkei is already down 508 points.

December 11, 2015

Credit Suisse Warns On China: "Some Companies Are Having To Borrow To Pay Staff Salaries"

During October, the credit impulse in China rolled over and died.

To be sure, the writing was on the wall before the data was released. Early in November, MNI suggested that according to discussions with bank personnel in China, data on lending for October was likely to come in exceptionally weak. As we noted at the time, that would mark a reversal from September when the credit impulse looked particularly strong and the numbers topped estimates handily. “One source familiar with the data said new loans by the Big Four state-owned commercial banks in October plunged to a level that hasn't been seen for many years,” MNI added.

Sure enough, when the numbers came in, new RMB loans to households fell 60% M/M and new loans to corporates declined nearly 40% from September.

To some, this was a shock. After all, multiple rate cuts and round after round of liquidity injections should have given banks plenty of dry powder to lend. But as we discussed at length, liquidity isn’t the issue.

December 10, 2015

America Crosses The Tipping Point: The Middle Class Is Now A Minority

Americans have long lived in a nation made up primarily of middle-class families, neither rich nor poor, but comfortable enough, notes NPR's Marilyn Geewax, but this year - for the first time in US history, that changed. A new analysis of government data shows that as of 2015, middle-income households have become the minority, extending a multi-decade decline that confirms the hollowing out of society as 49% of all Americans now live in a home that receives money from the government each month. Sadly, the trends that are destroying the middle class in America just continue to accelerate.

Back in 1971, about 2 out of 3 Americans lived in middle-income households. Since then, the middle has been steadily shrinking.

Today, just a shade under half of all households (about 49.9 percent) have middle incomes. Slightly more than half of Americans (about 50.1 percent) either live in a lower-class household (roughly 29 percent) or an upper-class household (about 21 percent).

As NPR explains, thanks to factory closings and other economic factors, the country now has 120.8 million adults living in middle-income households, the study found. That compares with the 121.3 million who are living in either upper- or lower-income households.

"The hollowing of the middle has proceeded steadily for the past four decades," Pew concluded.

And middle-income Americans not only have shrunk as a share of the population but have fallen further behind financially, with their median income down 4 percent compared with the year 2000, Pew said.

December 9, 2015

Guess What Happened The Last Time Junk Bonds Started Crashing Like This? Hint: Think 2008

The extreme carnage that we are witnessing in the junk bond market right now is one of the clearest signals yet that a major U.S. stock market crash is imminent. For those that are not familiar with “junk bonds”, please don’t get put off by the name. They aren’t really “junk”. They simply have a higher risk and thus a higher return than other bonds of the same type. And yesterday, I explained why I watch them so closely. If stocks are going to crash, you would expect to see a junk bond crash first. This happened in 2008, and it is happening again right now. On Monday, a high yield bond ETF known as JNK crashed through the psychologically important 35.00 barrier for the very first time since the last financial crisis. On Tuesday, high yield bonds had their worst day in three months, and JNK plummeted all the way down to 34.44. When I saw this I was absolutely stunned. This is precisely the kind of junk bond crash that I have been anticipating that we would soon witness.

Normally, stocks and junk bonds track one another very closely, but just like before the 2008 crash, they have become decoupled in recent months. Anyone that even has an elementary understanding of the financial world knows that this cannot continue indefinitely. And when they start converging once again, the movement could be quite violent.

When I chose to use the word “carnage” to open this article, I was not exaggerating what is going on in the junk bond market one bit. On Tuesday evening, Jeffrey Gundlach used the exact same word to describe what is happening…

December 8, 2015

Even Bank Supporters Arguing for Restoration of Glass Steagall

John Dizard, who perhaps by virtue of being one of the Financial Times’ most original and insightful columnists, is relegated to its weekend “Wealth” section, has written a particularly important pair of articles. Note that Dizard’s ambit is not policy wonkery but apt and often cynical observations about behavior and trading patterns in less visible part of the financial markets, and sometimes the spending habits of the uber-rich themselves, and what they portend for investments and the economy.

The week before last, Dizard penned an important piece, In the shadow of quantitative easing, party like it is 1788, in which he pointed out that the meant-to-be-stealthy part of the bank bailouts, ZIRP and quantitative easing, had served to shift the risk of the next crisis off the regulated parts of the financial system and onto investors, particularly long-term investors like life insurers and pension funds. His piece last weekend, The US financial industry should listen to leftwing reformers, builds on his observations about where risks sit to argue that the financial services industry would do far better to listen to critics and go back to a clearer separation between commercial banking and trading activities* than we have now.

Dizard chooses to depict the case for breaking up big banks as a pinko argument, when the Bank of England has also fought fiercely for it; it had to settle for ring-fencing because the UK Treasury campaigned hard. And the arguments that the Bank of England made are sound. For instance, Andrew Haldane has pointed out that one of the results of deregulation has been homogeneity in strategies, and even in how banks model risk, ranging from approaches like VaR to the pervasive use of FICO in the US. The result resembles an ecological system with a dominant species. They are much more prone to collapse than ones with more diversity.

I’m in favor of Glass-Steagall type reforms too, but for different reasons. I’ve regarded from my very first days working with commercial banks (and that was Citibank in the early 1980s, meaning a top player at the time) that the managerial requirements for investment banks and commercial banks are diametrically opposed. And what has developed over time is a Rube Goldbergian compromise which results in the worst of all possible worlds (well, save for the inmates): it leaves the foxes, as in the “producers” running the henhouse, with the nominal leaders of these organizations regularly pleading ignorance as to the fact that there is gambling taking place in their ranks.

December 7, 2015

BIS Warns The Fed Rate Hike May Unleash The Biggest Dollar Margin Call In History

Over the past several months, one of the biggest conundrums stumping the financial community has been the record negative swap spread which we profiled first in September, and which as Goldman most recently concluded, "has been driven by funding and balance sheet strains, especially since August."

Today, in its latest quarterly report, the Bank of International Settlement focused precisely on this latest market dislocation. According to the central banks' central bank, "recent quarters have witnessed unusual price relationships in fixed income markets. US dollar swap spreads (ie the difference between the rate on the fixed leg of a swap and the corresponding Treasury yield) have turned negative, moving in the opposite direction from euro swap spreads (Graph A, left-hand panel)."

Read the entire articleGiven that counterparties in derivatives markets, typically banks, are less creditworthy than the government, swap rates are normally higher than Treasury yields because of the additional risk premium. Hence, the negative spreads point to a possible dislocation. One set of factors relates to supply and demand conditions in interest rate swap and Treasury bond markets. In the swap markets, forces that can compress swap rates include credit enhancements in swaps, hedging demand from corporate bond issuers, and investors seeking to lock in longer durations (eg insurers and pension funds) by securing fixed rates via swaps.In cash markets, in turn, upward pressures on yields stemmed from the recent sales of US Treasury securities by EME reserve managers. The market impact of these Treasury bond sales may have been amplified by a second set of factors that curb arbitrage and impede smooth market functioning. First, the capacity of dealers’ balance sheets to absorb rising inventory may have been overwhelmed by the amount of US Treasury bonds reaching the secondary market in the third quarter (Graph A, centre panel), causing dealers to bid market yields above the corresponding swap rates. Second, balance sheet constraints may have made it more costly for intermediaries to engage in the speculative arbitrage needed to restore a positive swap spread. Such arbitrage is sensitive to balance sheet costs because it requires leverage, with a long Treasury position funded in the repo market.

December 4, 2015

Auto Loan Madness Continues As US Car Buyers Take On Record Debt, Lunatic Financing Terms

Way back in June, we noted that auto sales had reached 10-year highs on record credit, record loan terms, and record ignorance. We based that assessment on the following set of Q1 data from Experian:

- Average loan term for new cars is now 67 months — a record.

- Average loan term for used cars is now 62 months — a record.

- Loans with terms from 74 to 84 months made up 30% of all new vehicle financing — a record.

- Loans with terms from 74 to 84 months made up 16% of all used vehicle financing — a record.

- The average amount financed for a new vehicle was $28,711 — a record.

- The average payment for new vehicles was $488 — a record.

- The percentage of all new vehicles financed accounted for by leases was 31.46% — a record.

In short, the “renaissance” in US auto sales is being driven (no pun intended) by increasingly risky underwriting practices and this is leading directly to the securitization of shoddier and shoddier collateral pools in a return to the “originate to sell” model that drove the housing bubble over a cliff in 2008.

As Comptroller of the Currency Thomas Curry recently put it, “what's happening in the auto loan market reminds me of what happened in mortgage-backed securities in the run-up to the crisis.”

December 3, 2015

Alarm Bells Go Off As 11 Critical Indicators Scream The Global Economic Crisis Is Getting Deeper

Economic activity is slowing down all over the planet, and a whole host of signs are indicating that we are essentially exactly where we were just prior to the great stock market crash of 2008. Yesterday, I explained that the economies of Japan, Brazil, Canada and Russia are all in recession. Today, I am mainly going to focus on the United States. We are seeing so many things happen right now that we have not seen since 2008 and 2009. In so many ways, it is almost as if we are watching an eerie replay of what happened the last time around, and yet most of the “experts” still appear to be oblivious to what is going on. If you were to make up a checklist of all of the things that you would expect to see just before a major stock market crash, virtually all of them are happening right now. The following are 11 critical indicators that are absolutely screaming that the global economic crisis is getting deeper…

Read the entire article

Read the entire article

December 2, 2015

Banks to Have Fed Dividends Clipped to Pay to Fill Potholes; JPMorgan, Bank of America the Biggest Losers

Yesterday, the general public scored a small but important victory over the Fed and the banking-industrial complex. To help fund the highway trust, which repairs highways and bridges, Congress released a compromise to the highway funding bill that whacks a long-standing subsidy to banks. This measure has high odds of passing.

Part of the funding will come from a cut the dividend the Fed pays to member banks on their non-voting preferred stock holdings. It will drop from 6% to the 10 Treasury bond yield at the time of the dividend payment, which currently is 2.3%, with a cap at 6% for banks with more than $10 billion in assets. This was a compromise from the original proposal, to cut the dividend to 1.5% for banks with over $1 billion in assets.

The banks that will see the biggest decline in income in 2016 as a result of this change will be JP Morgan and Bank of America, at roughly $200 million each. Media reports suggest that this change will produce $8 to $9 billion in revenue, but the experts to whom I’ve spoken estimate the take at $12 to $15 billion over the next ten years.

While this is not the most earthshaking change, it is nevertheless important for several reason. First, it is a sign of the decline in reputation and power of the Fed as well as of the banking lobby. This provision was included in the highway funding bill, which was where it was first proposed in its current form (the idea had initially surfaced as an idea in the Progressive Caucus’s budget proposal). It had been removed from the House version of the bill but was reinserted in the reconciliation talks.

Read the entire article

Part of the funding will come from a cut the dividend the Fed pays to member banks on their non-voting preferred stock holdings. It will drop from 6% to the 10 Treasury bond yield at the time of the dividend payment, which currently is 2.3%, with a cap at 6% for banks with more than $10 billion in assets. This was a compromise from the original proposal, to cut the dividend to 1.5% for banks with over $1 billion in assets.

The banks that will see the biggest decline in income in 2016 as a result of this change will be JP Morgan and Bank of America, at roughly $200 million each. Media reports suggest that this change will produce $8 to $9 billion in revenue, but the experts to whom I’ve spoken estimate the take at $12 to $15 billion over the next ten years.

While this is not the most earthshaking change, it is nevertheless important for several reason. First, it is a sign of the decline in reputation and power of the Fed as well as of the banking lobby. This provision was included in the highway funding bill, which was where it was first proposed in its current form (the idea had initially surfaced as an idea in the Progressive Caucus’s budget proposal). It had been removed from the House version of the bill but was reinserted in the reconciliation talks.

Read the entire article

December 1, 2015

Paper Gold Dilution Hits 294x As Comex Registered Gold Drops To New All-Time Low

One week ago, gold market observers were surprised when in the span of four days, gold held in the JPM Comex vault declined by nearly 50%, starting on November 16 when the 668,498 ounces held in the vault below 1 Chase Manhattan Plaza declined precipitously to just 347,899 ounces, a new all time low.

Furthermore, as of the latest Comex activity update, on Friday the Registered gold held by JPM dropped another 2,802 ounces to a record low and virtually negligible 7,975 ounces, essentially equivalent to zero as shown in the chart below, even as JPM's eligible gold has also been seeing a substantial decline in recent months.

But while the decline of JPM gold has long been noted, it was the latest drop in total Comex registered gold which has again raised eyebrows, and which contrary to expectations it would be replenished either from external inflows or by conversion from Eligible both of which have not happened, has instead continued to decline. According to the latest data, total Registered gold dropped by another 11% overnight to just 134,877 ounces, just over 4 tonnes and another all time low...

... and since the gold open interest remains largely unchanged, the physical gold coverage ratio, or the ratio of gold claims to Registered gold, has just hit an all time high of 294 ounces of paper for every ounces of physical.

Subscribe to:

Posts (Atom)