The following list compiled by Bloomberg shows the amount of debt that these various nations must roll over in 2012....

Japan: 3,000 billion

U.S.: 2,783 billion

Italy: 428 billion

France: 367 billion

Germany: 285 billion

Canada: 221 billion

Brazil: 169 billion

U.K.: 165 billion

China: 121 billion

India: 57 billion

Russia: 13 billion

Up until recently, these powerful nations have been able to easily roll over their debts each year because lenders have been willing to shower them with gigantic quantities of very cheap money.

But in 2011 bond yields for many European nations really started to soar. When the cost of borrowing goes up, that puts a lot more pressure on the finances of nations that are already very deep in debt.

According to Bloomberg, it is being projected that borrowing costs for G-7 nations will rise very rapidly in 2012 as well....

Borrowing costs for G-7 nations will rise as much as 39 percent from 2011, based on forecasts of 10-year government bond yields by economists and strategists surveyed by Bloomberg in separate surveys.

Rising borrowing costs are a major reason why Italy is on the verge of financial collapse right now.

A year ago, the yield on 10 year Italian bonds was below 5 percent. Today it is up around 7 percent.

During 2012, Italy must refinance approximately $428 billion of government debt. If the rest of the world is not willing to buy that much Italian debt at current interest rates, that it going to create a major crisis.

Of course the European Central Bank could intervene even more than it has been, but there is a limit to what the ECB can do under current agreements.

The truth is that the European Central Bank has already spent over 274 billion dollars buying up the government bonds of troubled European nations such as Greece, Italy, Portugal and Ireland in an attempt to control the rise of bond yields.

But even with such unprecedented intervention, bond yields have still risen substantially.

Germany and other northern European nations are adamantly against the ECB directly funding the deficit spending of profligate southern European nations. Germany has insisted that troubled nations such as Greece and Italy deal with their debt problems by implementing brutal austerity programs.

But all of this austerity will almost certainly bring on a major recession. The following analysis comes from a recent article by Ambrose Evans-Pritchard....

The European Central Bank has guaranteed trouble by letting M3 money contract. Fiscal tightening into the downward slide will make matters worse. A credit crunch as banks shrink loan books by €1 trillion to meet capital ratios will do the rest. All policy levers are set on deep recession, and deep recession is what Europe will get.

And a deep recession will only make the debt problems of European nations even worse.

But Europe is not the only one in trouble.

Japan is also on the verge of complete and total financial collapse. The government of Japan spends more than twice as much as it brings in, and public debt has risen to 237 percent of GDP.

Up until now, the Japanese government has gotten away with this because the Japanese people are great savers and they have been willing to lend huge mountains of money to the Japanese government for very little return.

But there are signs that the situation in changing, and if interest rates on Japanese debt go up even just a few percentage points it is going to be a total nightmare for Japan.

There is simply way too much debt all over the world. Greece thought that they would be able to borrow cheap money forever, but now look at them. The yield on 2 year Greek bonds is now up to 134%.

All of these nations that are gobbling up cheap money now should take note that this supply of cheap money will not last forever.

Unfortunately, our world has gotten completely and totally addicted to debt. The following comes from a recent article by John Mauldin....

Total debt-to-GDP levels in the 18 core countries of the Organisation for Economic Co-operation and Development (OECD) rose from 160 percent in 1980 to 321 percent in 2010. Disaggregated and adjusted for inflation, these numbers mean that the debt of nonfinancial corporations increased by 300 percent, the debt of governments increased by 425 percent, and the debt of private households increased by 600 percent.

Of course the biggest debt of all is the national debt of the United States. As of this moment, the U.S. national debt is $15,222,940,045,451.09, and the debt recently surpassed the 100 percent of GDP mark.

So why haven't things collapsed already?

Well, it is because the U.S. can still borrow massive amounts of cheap money.

Right now, the average interest rate on U.S. debt is approximately 2.18 percent.

That is very, very low and it will not last forever. When it rises we will be in a heap of trouble.

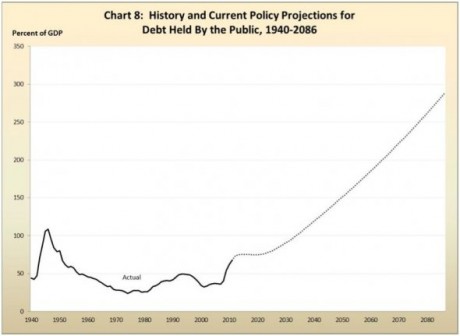

And in future years our debt is projected to rise to absolutely insane levels. The following chart comes from a GAO report that was just released. To be honest, the projections that the GAO report uses are so optimistic that they are beyond ridiculous. But even using those ridiculously rosy financial estimates, U.S. government debt is still projected to skyrocket to absolutely unprecedented heights in future years....

Once again, please keep in mind that the GAO chart above is based on projections that are unbelievably optimistic.

We are in a massive amount of trouble my friends.

At this point, we owe the Chinese nearly a trillion dollars. They are running out of things to do with all the money they have gotten from us. Recently it came out that the Chinese actually want to buy Yahoo.

We are mortgaging our future, and for what?

We have been so incredibly foolish.

So what is the solution?

How will our "leaders" solve our debt problems?

Well, world famous investor Kyle Bass recently said that a senior member of the Obama administration told him that "we are just going to kill the dollar".

That doesn't sound good.

So are we really going to print our way out of trouble?

Or will our financial system just simply collapse under the weight of so much debt at some point?

If our system does collapse, people are going to want something new. Unfortunately, a growing number of Americans seem to think that socialism is the answer. According to a new Pew Research Center poll, Americans between the ages of 18 and 29 actually have a more favorable view of socialism than they do of capitalism right now.

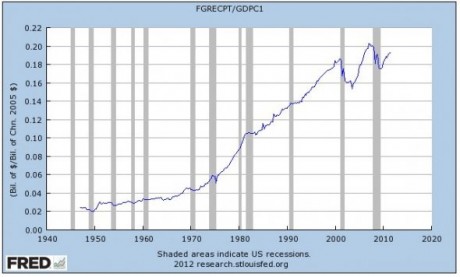

That is very sad. The truth is that America has already been marching towards socialism for many decades. The federal government just keeps taking more of our money and just keeps spending more of our money. The following chart below shows how federal receipts have risen as a percentage of GDP over the last 60 years....

If there is a massive global financial collapse, another solution that will inevitably be put forward is for the world to adopt a global currency.

The seeds for this have been planted for many, many years. In dozens of books, television shows and movies about the future a "global currency" plays a major role.

Sadly, more than 40 percent of all Americans believe that we will see a global currency by the year 2050. The following comes from a recent article in Wired Magazine....

But does this mean we don’t see a global currency in our future? For many, the answer is no. A recent Pew Research poll reveals that 41 percent of Americans expect it by 2050. Maybe the idea has been planted in our heads by leftist utopians and science fiction authors: a system of “credits” is used in everything from Star Wars, Star Trek, and Babylon 5 to the Foundation book series. Yet the idea has also been touted by economics titans like John Maynard Keynes.

Let us hope that the United States never is part of a global currency, because that would be the end of our national sovereignty.

But one thing is for sure - the world will never be the same after this debt crisis plays out.

Enjoy the prosperity of today while you can, because there is no way that it can last.

A massive financial collapse is coming, and it is going to shake the entire globe.

Sadly, most people simply do not care about the debt bomb that is hanging over the nations of the world, and the coming crisis is going to devastate their lives without any warning.

No comments:

Post a Comment