As readers no doubt have noticed, we’ve been drilling into the private equity industry of late, focusing more on investor issues than on the industry’s impact on companies, industries, and wage rates. Supposedly savvy limited partners being ripped off does, at first blush, appear to be far less pressing than buyout firms using financial engineering and cost cutting to reap mind-bogggling riches for the general partners’ top players, leaving the more than occasional bankrupt company in their wake.

Make no mistake: Private equity general partners are the biggest rentiers in the economy. They control large swathes of the real wealth of America, which is its companies. Yes, there is a sector of the industry that actually tries and for the most part does earn its returns by focusing on operating improvements in companies. These are businesses that are not managed professionally and need to implement better systems and procedures or add new capabilities to grow further. But these deals are on the mid to small end of the industry, generally topping out at acquisition sizes of $350 million. They represent a minority of total dollars committed to private equity.

And even these “better” operators still make use of leverage (although not as much as the financially-oriented buyers) and other tax strategies that reduce the tax bill of their investee companies to far lower levels than before the acquisition. In other words, their returns depend to a not-trivial degree on transfers from taxpayers to private equity investors.

So why our concern with the investor side? The power of the private equity industry rests on its access to investment dollars. Until limited partners question their rationales for investing in private equity, it continue to be difficult to curb the industry’s influence and activities. Remember all the criticism of Mitt Romney’s tenure as head of Bain Capital, including a devastating analysis of Bain deals by David Stockman? All that critical public scrutiny seems to have produced in the way of tangible outcomes is renewed demonstration of private equity’s overweening sense of entitlement, such as Tom Perkins’ widely-criticized letter to the Wall Street Journal in which he tried to depict criticism of the uber-rich as paving the road to “decadent ‘progressive’ thinking” and a new Kristallnacht.

The big reason for private equity’s untouchable status is that the overwhelming majority of its investors are convinced that private equity delivers better returns than any other strategy. That belief is largely intact despite disappointing returns post-crisis and a long-standing lack of any decent studies of overall private equity performance.

A must-read book new book on private equity, Private Equity at Work, by Eileen Appelbaum and Rosemary Batt, has made an exhaustive examination of the academic literature on numerous aspects of private equity, as well as examining important legal issues and providing numerous well-researched case studies. Their chapter on private equity returns is particularly troubling, and they’ve supplemented that with a new paper at the Center for Economic and Policy Research, part of a series related to their book.

Private equity, which consists of venture capital (about 15% of industry assets) and buyouts, is illiquid. Unlike investing in stocks, bonds, or even hedge funds, investors in private equity cede to the private equity general partners complete control of when they send in the money and when they get it back.

As Appelbaum and Batt point out in their book, private equity investors expect the strategy to earn 300 to 400 basis points more than the stocks, with the most common reference index the S&P 500, as compensation for private equity’s illiquidity. So notice that even on the investors’ own terms, if private equity delivers 300 to 400 basis points over the S&P 500, they are merely getting an adequate return for the risk they are taking. They are not getting a superior return. As we pointed out in a recent post:

Harvard has acknowledged that private equity has underperformed public stocks over the last decade before allowing for the illiquidity premium:Harvard expects an “illiquidity premium” from private equity over public markets because of the long lock-up periods investors agree to, Mendillo [the Harvard Management CIO] said. “Over the last 10 years, however, our private equity and public equity portfolios have delivered similar results,” she said.

And keep in mind that illiquidity risk is real. Life insurers, which also have long-term investment horizons like pension funds (the biggest investor group in private equity), typically have much lower commitments. Why? State regulators and ratings agencies both restrict how much they can commit to illiquid investments. Remember, supposedly savviest of the savvy Harvard had Larry Summers blow a hole in its capital by making bad bets on interest rate swaps. Harvard had to scramble to meet its budget and cancelled projects and even ongoing student programs (no more hot breakfasts!) to deal with the fallout. Managing around illiquid private equity holdings made this difficult process even worse.

In addition, as we’ll discuss more in future posts, the private equity limited partnership agreements that we’ve published show that private equity capital calls (as in their demand that investors send money) have five-day required responses and draconian consequences for missing a capital call.

So what returns does private equity deliver? Astonishingly, for an investment strategy that has been in existence for over 30 years, no one has a good answer. As Appelbaum and Batt point out, there is no industry-wide data set of private equity performance. The fact that private equity firms continue to resist releasing the data necessary to analyze returns should in and of itself be a huge red flag.

Most studies have relied on cherry-picked data sets supplied by the private equity general partners. And even more rich, who has performed these studies? Almost without exception, finance professors who are members of business school faculties. Who are the biggest funders of business school endowments? At many schools, private equity firms. In other words, taking a critical stance towards the industry would not be a career-advancing move for a budding young scholar.

Even private-equity-industry-friendly McKinsey stated recently that they viewed only two studies of private equity returns as being reliable (conveniently, those papers confirmed that private equity does deliver that required 300 basis point premium over stocks). Appelbaum and Batt, who discuss the studies and their assessment of them in far more detail, have a more nuanced and generally dimmer view. This is the summary of their findings:

Because there is no publicly available or comprehensive data set on private equity, all studies of performance suffer from incompleteness and biases, and different methods of calculating returns lead to different results. But some methodologies and data sets are more credible than others. Reports that PE funds substantially outperform the stock market come almost entirely from industry sources that use the internal rate of return as a measure of performance. This measure is deeply flawed, for reasons examined in this chapter, and many finance scholars reject its use. Industry reports are also biased, as they rely on the data and methods of self-interested parties.

Our review covers the most credible research by top finance scholars. They report much more modest returns to private equity funds, with some showing that the median fund does not beat the stock market and others showing that median returns are only slightly above the stock market. The most positive findings for private equity generally compare it to the S&P 500 and report that the median fund outperforms the S&P 500 by 1 percent and the average by 2 to 2.5%. According to these studies, the higher-than-average performance is driven by the top quartile of funds – and particularly the top decile. With the exception of these top performing funds, returns do not cover the roughly 3 percent additional returns that investors typically calculate as required to compensate them for the added risk and illiquidity of private equity investments.

This assessment is more deadly than it sounds. As a finance professional who has spent a lot of my career performing valuations, I find the fact that private equity investors have been conned into relying on internal rate of return as a performance metric to be shocking. If I had used IRR to calculate returns in a finance exam, I would have gotten a failing grade. See here for a short discussion of why IRR is a poor choice for measuring returns. The key sentence from this McKinsey article: “…. typical IRR calculations build in reinvestment assumptions that make bad projects look better and good ones look great.”

More sophisticated analysts and investors call for the use instead of “public market equivalent” as the measure of private equity returns, which compares the returns of private equity funds to what would have been realized had the fund invested in the reference investment instead. And notice that the widespread use of the S&P 500 as a benchmark is also flattering to private equity. Private equity invests in vastly smaller companies than those in the S&P 500, and a smaller-stock index would generally show higher returns.

But making a rigorous return calculation using public market equivalent requires that the fund be liquidated, which is typically ten years after its commitment date. Otherwise, analysts have to rely on the private equity fund’s self-assigned “net asset value” for the investments that have yet to be sold. Academic studies have found that those valuations are goosed at around the time when private equity firms are raising new funds and the air is taken out of the marks over time. But the requirement that rigor means looking only at fully liquidated funds also means that the best studies have yet to pick up post crisis underperformance in the boom of private equity fundraisings in the runup to the crisis.

Finally, the private equity has gotten tremendous mileage out of currying investor belief that they can beat the odds and invest in top quartile funds. We debunked that myth in an older post. But bizarrely, the fantasy that investors can find those funds continues even after two separate studies determined that persistence of outperformance of top quartile funds ended in the late 1990s.

We’ve also had private equity industry defenders in comments try to claim that private equity delivers consistent high performance “year after year”. That too is inaccurate. Private equity is highly cyclical. And remember, when looking at these charts, that institutional investors in private equity generally make commitments year after year. They don’t try to market-time, although they will reduce or increase their allocation to various strategies, including private equity, periodically.

Appelbaum and Batt discuss the not-widely-acknowledged cyclicality of private equity in their CEPR paper:

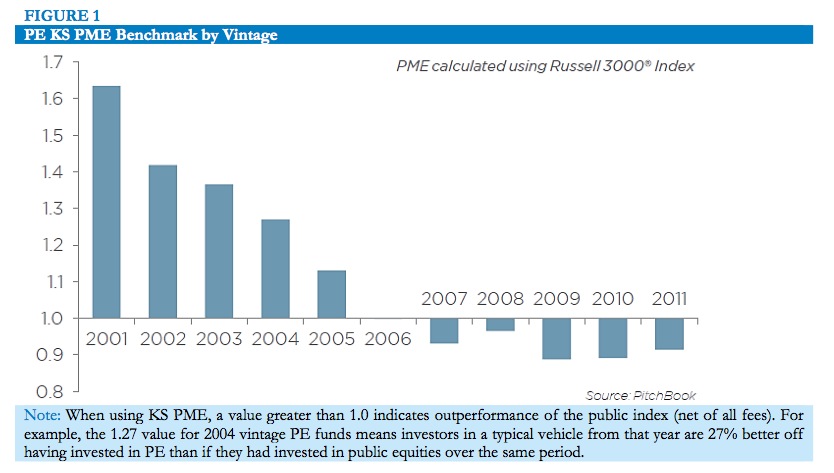

The public market equivalent (PME) benchmark developed by Steven Kaplan and Antoinette Schoar makes it possible to directly compare private equity fund performance to the performance of a stock market index such as the Russell 3000 that consists of publicly traded companies of the same size as most companies acquired by PE funds. Figure 1 below, from the 2014 Q2 PitchBook benchmarking and fund performance report, shows how the performance of the typical PE fund from the date of its inception compares with that of the stock market over the same period.

Figure 1 shows quite dramatically both that PE returns are highly cyclical and that they have fallen steadily since the 2001 vintage year. Funds launched in the years immediately following the dot-com bust, when the stock market was in the doldrums and enterprise values for publicly traded and family-owned businesses were low, typically outperformed the stock market by a wide margin in subsequent years – enough to make investing in private equity worthwhile. The 1.27 value of the PME for the typical fund launched in 2004, while below the value in earlier years, indicates an outperformance of 27 percent since the fund’s inception 9 years earlier, or an annual outperformance of just under 2.7 percent. The typical fund launched a year later, in 2005, beat the s tock market by just 10 percent since inception, or by 1.2 percent a year over the subsequent 8 years. Funds launched in any year after 2005 have done much worse and have typically failed to beat the stock market.

It is important to understand that this issue is also more important than it seems. An investment strategy does not legitimately rise to the prized status of being an asset class unless its returns do not correlate much with that of established asset classes like stocks and bonds. The discussion above clearly shows that private equity returns are influenced by public market returns.

Yet limited partners have chosen to buy the general partners’ propaganda that private equity returns don’t covary much with the stock market. If you believed that palaver, you’d see value in investing in private equity merely for portfolio diversification, and not for performance alone.

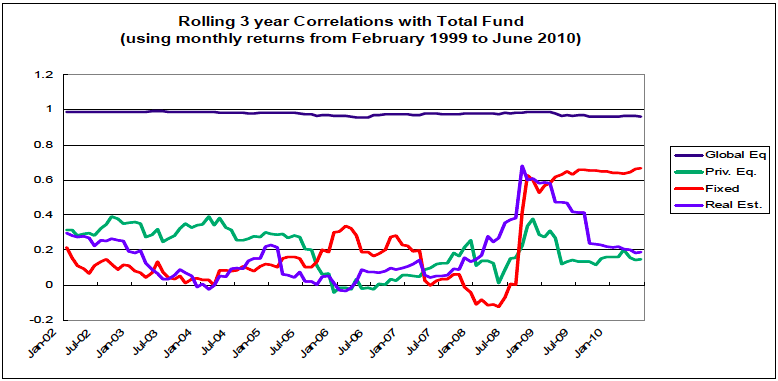

So another proof of the degree of limited partners’ intellectual capture is that they not only accept the use of IRR which exaggerate private equity returns but also believe preposterous claims by the general partners that there is little correlation between public versus private equity values. For example, the chart below shows the historic correlation supposedly experienced by CalPERS of its private equity portfolio and its global public equity portfolio compared to its total fund performance.

This very low correlation is simply not plausible in the real world. Whether an asset is privately or publicly owned should have little, if any, effect on its value. But make no mistake, many limited partner investors in private equity view what is generously called “smoothing” of valuation volatility (aka, “fibbing”) by the general partners to be a feature, not a bug, of private equity investing, since it allows the limited partners’ portfolios to appear less volatile than they otherwise would (though CalPERS is clearly skeptical of this low correlation claim, since it assigns a going-forward correlation between public and private equity of 0.75).

Now as indicated, some of the investors widely seen as sophisticated look to be less enamored with private equity than in the past. You may recall the comment above from Harvard’s CIO that private equity isn’t meeting their risk-return requirements; in late May, CalPERS was reported to have cut its allocation to private equity for the second time in three months. More sober-minded assessments are long overdue, and we can only hope that the combination of private equity grifting exposed by the SEC and the diminished enthusiasm shown by industry leaders will induce other limited partners to reassess their level of commitment.

No comments:

Post a Comment