Unfortunately, many of the explanations for why that happened are more than a bit off.

The original report came in Gallup last week. Key section:

The U.S. now ranks not first, not second, not third, but 12th among developed nations in terms of business startup activity. Countries such as Hungary, Denmark, Finland, New Zealand, Sweden, Israel and Italy all have higher startup rates than America does.

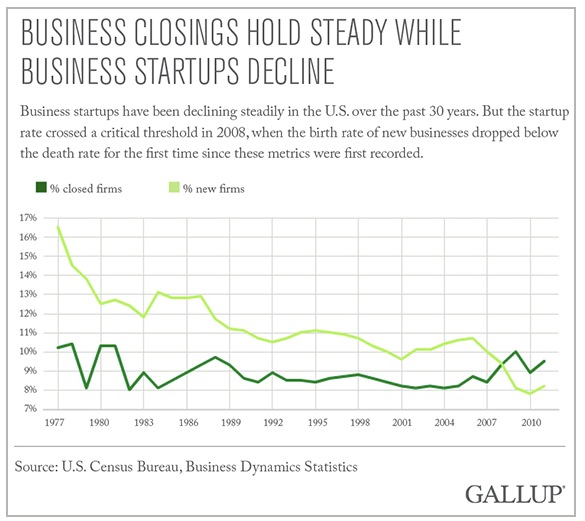

We are behind in starting new firms per capita, and this is our single most serious economic problem. Yet it seems like a secret. You never see it mentioned in the media, nor hear from a politician that, for the first time in 35 years, American business deaths now outnumber business births.

This change is critically important because small and medium sized businesses are the creators of new jobs. Large corporations have in aggregate been in liquidation mode for well over a decade, net saving and net shedding employees. You can see this behavior in the regularity with which the business press reports on headcount-cutting exercises, as if they are mere cost cutting exercises, as opposed to a sign of how deeply unwilling large corporations are to invest in their workers and their futures.

Business startups outpaced business failures by about 100,000 per year until 2008. But in the past six years, that number suddenly reversed, and the net number of U.S. startups versus closures is minus 70,000.

Notice how the change dates to the crisis? This is no accident. While correlation is no proof of causation in and of itself, it’s not hard to fill in causal drivers.

The Gallup article lays on thick the mythology of American entrepreneurship, as if its some sort of value or character attribute we are losing, like the old Roman virtue, and that it rests on “innovation”. The problem is that the cultural hype is based on high-flying, often venture-capital funded startups. Worse, not just journalists but also even academics have fixated on venture-capital backed young companies, even though they account for only 1% of total new ventures in most years and only 25% of the Inc. Magazine 500 roster of most successful high-growth companies.

So what about the understudied overwhelming majority of startups that are the real job engine of America? What are they like?

In his landmark study, The Origin and Evolution of New Ventures, Amar Bhide found that the most common path for successful entrepreneurs was that they had worked for large, established industry players and noticed a market niche that wasn’t served well. The most common way these new businesses were funded were savings, borrowing from friends and family, and credit cards.

Now if you think for a bit about what has been happening in our economy, and in the business world overall, you can see how the impact of the crisis and its aftermath would lead anyone with an operating brain cell to be cautious about hanging out their own shingle.

First, a classic balance sheet recession means a slow and weak recovery, as we have seen all to well. Coddling Wall Street has exacted a high toll on Main Street, and the players at risk like small business most of all. Only recently have small businessmen expressed a decent level of optimism about the economy and hiring. But even with that, there are a lot of headwinds, such as a questionable outlook for retail, which is one of the most popular targets for new ventures.

Second is that a lot of people had their savings depleted or wiped out during the crisis due to job losses or hours cutbacks. And older people who have some capital are still facing a low interest rate environment, and questionable prospects for capital gains. While that may make some more willing to take a flier, many people respond instead by working to save even more (if they are still working), trying to find not horribly risky income producing assets, and being careful about risk taking. In general, when times are robust, most investors have higher risk tolerances than when times are bad or uncertain. So the savings and friends and family route for getting funding also is not what it used to be.

Third is that credit card companies slashed credit lines during the crisis, felling a lot of ventures that relied on seasonal credit. And two important small business credit card lenders have exited the business or cut back on their offerings. Advanta failed, and American Express, which used to offer a suite of small business funding products, such as a capital lines, has eliminated some of its products and has become more stringent on how much credit it provides on its business card products.

There is an additional development which is longer term and was exacerbated by the crisis, which is short job tenures. It’s hard to get enough insight about customer behavior and what it might take to compete with or sidestep industry incumbents if you don’t spend enough time at a company to understand its operations and processes. Related to that is that many companies now make workers sign highly restrictive non-compete agreements as a condition of employment, making it hard for them not just to join other companies but go out on their own.

So while Wall Street isn’t the sole perp in the decline of American entrepreneurship, it is still a leading perp. And that’s why it is important not to give up on the effort to cut our hypertrophied finance sector down to size.

Source

No comments:

Post a Comment